Unlimited Investments for your IRA or 401(k)

Invest quickly and Tax-free!

As seen in:

Our Self-Directed Retirement Solutions

-

Self-Directed IRA

Self-Directed IRA

-

Self-Directed IRA LLC

Self-Directed IRA LLC

-

IRAfi Crypto™

IRAfi Crypto™

-

Solo 401(k)

Solo 401(k)

-

ROBS

ROBS

Benefits:

(with credit card on file)

Benefits:

(with credit card on file)

By utilizing the IRA LLC structure, you have total “checkbook control” to make investments when you want, without custodial consent.

Benefits:

(with credit card on file)

By utilizing the IRA LLC structure, you have total “checkbook control” to make investments when you want, without custodial consent.

Benefits:

(with credit card on file)

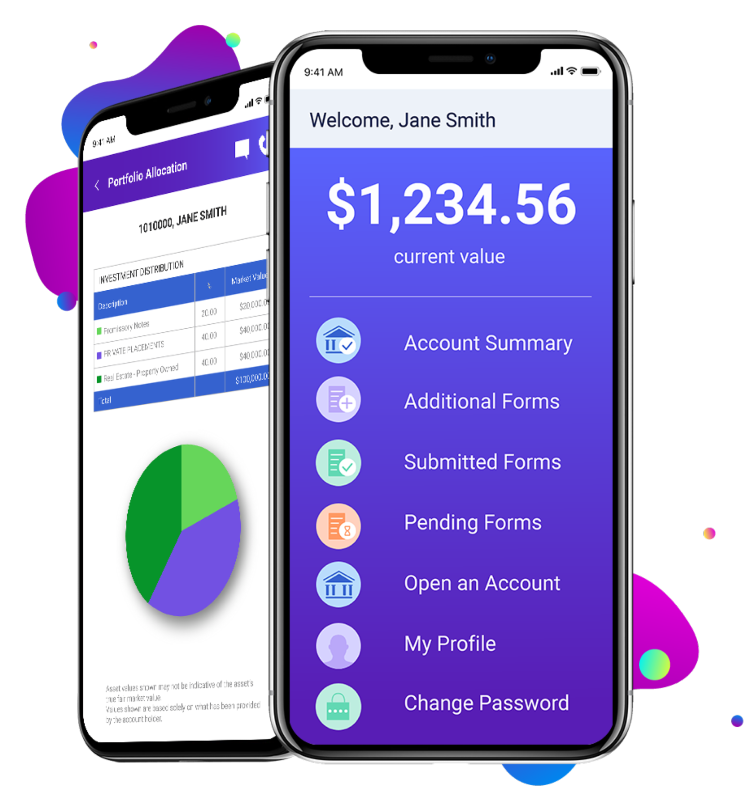

With the all-new IRAfi Crypto™ trading app, you can now buy, sell, and trade the most popular cryptos, including Bitcoin (plus over 25 more), for a low, annual fee of just $100.

Benefits:

With the all-new IRAfi Crypto™ trading app, you can now buy, sell, and trade the most popular cryptos, including Bitcoin (plus over 25 more), for a low, annual fee of just $100.

Benefits:

Benefits:

(with credit card on file)

Benefits:

(with credit card on file)

An IRS-approved structure that allows you to use retirement funds to start your own business or raise capital for an existing business.

Benefits:

An IRS-approved structure that allows you to use retirement funds to start your own business or raise capital for an existing business.

Benefits:

Let AI pick your perfect Self-Directed solution!

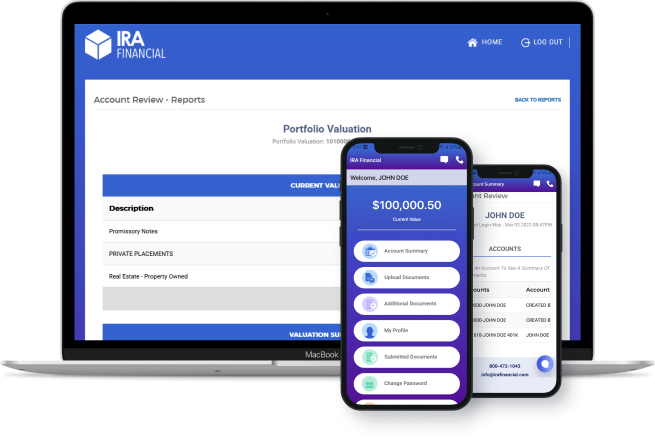

Getting Started is Easy

1. Begin the process

Fill out our quick app to get started today!

2. We’ll get in touch

A self-directed specialist will work one-on-one with you to finish the application - we'll be with you every step of the way!

3. Start investing

Fund your account and invest in your future!

Why IRA Financial?

Experience

Our tax and ERISA experts have helped over 24,000 clients invest $3.2 billion in alternative assets.

Individual Dedicated Support

IRA Financial gives clients access to experienced specialists dedicated to your peace of mind.

Flat Fees

With no hidden fees, IRA Financial is proud to offer award-winning service with the best pricing structure available.

Endless Investments Opportunities

Real Estate

Whether it’s residential or commercial, rental properties or raw land, real estate is the #1 alternative investment among retirement investors.

Precious Metals

Metals and coins have long been used as a hedge against a volatile economy – just make sure they are IRS-approved precious metals and not held personally.

Private Placements

Investment opportunities offered to a select group of high net worth or institutional investors that have reduced risk and assured returns.

Tax Liens/Deeds

Tax liens and deeds allow for exposure to the real estate market in your portfolio without having to invest in the properties themselves

Investment Funds

Hedge funds and private equity fund investments are generally for more sophisticated, accredited investors.

With a self-directed retirement plan, you can invest in anything not prohibited by the IRS.