Self-Directed IRA for Real Estate

A Self-Directed IRA allows you to use your IRA to invest in real estate. Learn how you can use your retirement funds to invest in real estate.

Can I Invest in Real Estate with my IRA?

A Self-Directed IRA is essentially an IRA that allows for alternative asset investments, such as real estate or even cryptocurrency. Traditional financial institutions do not allow IRAs to invest in IRS-approved alternative assets, such as real estate, because they focus on earning fees through traditional investments.

When it comes to making investments with a self-directed IRA, the IRS generally does not tell you what you can invest in, only what you cannot invest in. The types of investments that are not permitted to be made using retirement funds are outlined in Internal Revenue Code Section 408 and 4975. These rules are generally known as the “Prohibited Transaction” rules. Other than life insurance, collectibles, and transactions that involve or directly or indirectly benefit the IRA holder or a “disqualified person,” one can use their IRA to make the investments. A “disqualified person” is generally defined as the IRA holder and any of his or her lineal descendants and any entities controlled by such persons.

Key Points

- One can use IRA funds to invest in alternative assets, including real estate

- Real Estate remains the number one alternative investment among retirement investors

- You should be aware of the IRS rules before investing

Two Great Ways to Buy Real Estate in a Self-Directed IRA

Self-Directed IRA for Real Estate

With a full-service Self-Directed IRA, a special IRA custodian, IRA Financial, will serve as the custodian of the IRA. Unlike a typical financial institution which generates fees by selling products and providing investment services, a self-directed IRA custodian earns fees by simply opening and maintaining IRA accounts and does not offer any financial investment products or platforms. With a full-service Self-Directed IRA, the IRA funds are generally held with the IRA custodian. The IRA owner will then direct the IRA custodian to invest the IRA funds in IRS-approved alternative asset investments, such as real estate. The title to the Self-Directed IRA asset will be in the name of the self-directed IRA custodian care of the IRA owner. For example: IRA Financial Trust Company CFBO John Doe IRA.

A self-directed IRA that is full-service is popular with retirement investors looking to invest in alternative assets that do not involve a high frequency of transactions, such as the purchase of raw land or private fund investments.

Read More: What is the Minimum Amount to Invest in Real Estate with a Self-Directed IRA?

Self-Directed IRA LLC for Real Estate

With a Self-Directed IRA with checkbook control, an IRA is set up with a Self-directed IRA custodian, such as IRA Financial. The IRA is then invested into a special purpose limited liability company (“LLC”), which IRA Financial can help you establish. The self-directed IRA LLC is then managed by the IRA owner providing the IRA owner with “checkbook control” over the IRA funds. With a “checkbook control” self-directed IRA LLC, the manager of the Self-Directed IRA LLC will have the authority to make investment decisions without the involvement of the custodian. Plus, a self-directed IRA LLC will offer the IRA owner limited liability protection over IRA investments. Moreover, all self-directed IRA investments will be titled in the name of the LLC offering the IRA owner more privacy. without needing the consent of an IRA custodian. With a Self-Directed IRA LLC with “Checkbook Control’ you will be able to buy real estate by simply writing a check.

Read More: Importance of Investment Diversity

What Real Estate Investments Can I Make with a Self-Directed IRA?

Below is a partial list of domestic or foreign real estate-related investments you can make with a Self-Directed IRA:

- Raw land

- Farmland

- Residential homes

- Commercial property

- Apartments

- Duplexes

- Condos/townhomes

- Rental Properties

- Mobile homes

- Real estate notes

- Real estate purchase options

- Tax liens certificates

- Tax deeds

Learn More: Self-Directed IRA to Flip Houses

Did you know that you can also use a loan to invest in real estate with a Self-Directed IRA?

Learn More: Using a Loan to Make an Investment

Advantages of a Self-Directed IRA to Purchase Real Estate

Real estate is one of the most popular retirement investments among self-directed investors. One primary reason is that real estate is a tangible asset that produces steady income. For many investors, particularly those with real estate experience, it has been an integral investment in building retirement wealth. The investment may also appreciate; however, this is dependent on the location of the land or property.

Below are the main advantages of using a self-directed IRA to buy real estate.

Tax-Deferral: In general, all income and gains from a self-directed IRA real estate investment will be tax-deferred or tax-free in the case of a Roth IRA.

Inflation protection: Having the ability to invest in certain hard assets, such as real estate is viewed as a good way to protect your retirement account from inflation since real estate is a hard asset and rental income can generally be adjusted annually to take into account an increase in inflation.

Diversification: Most American’s savings are tied to the stock market. Investing in alternative assets, such as real estate offers your retirement accounts a great way to diversify from the equity markets and gain access to a hard asset that can offer steady cash flow as well as asset appreciation.

Hard Asset: Real estate is a tangible hard asset that you can see and touch. For some, that’s important psychologically, especially in times of financial instability, inflation, or political or global upheaval.

Learn More: How to Correctly Diversify Your Retirement Portfolio

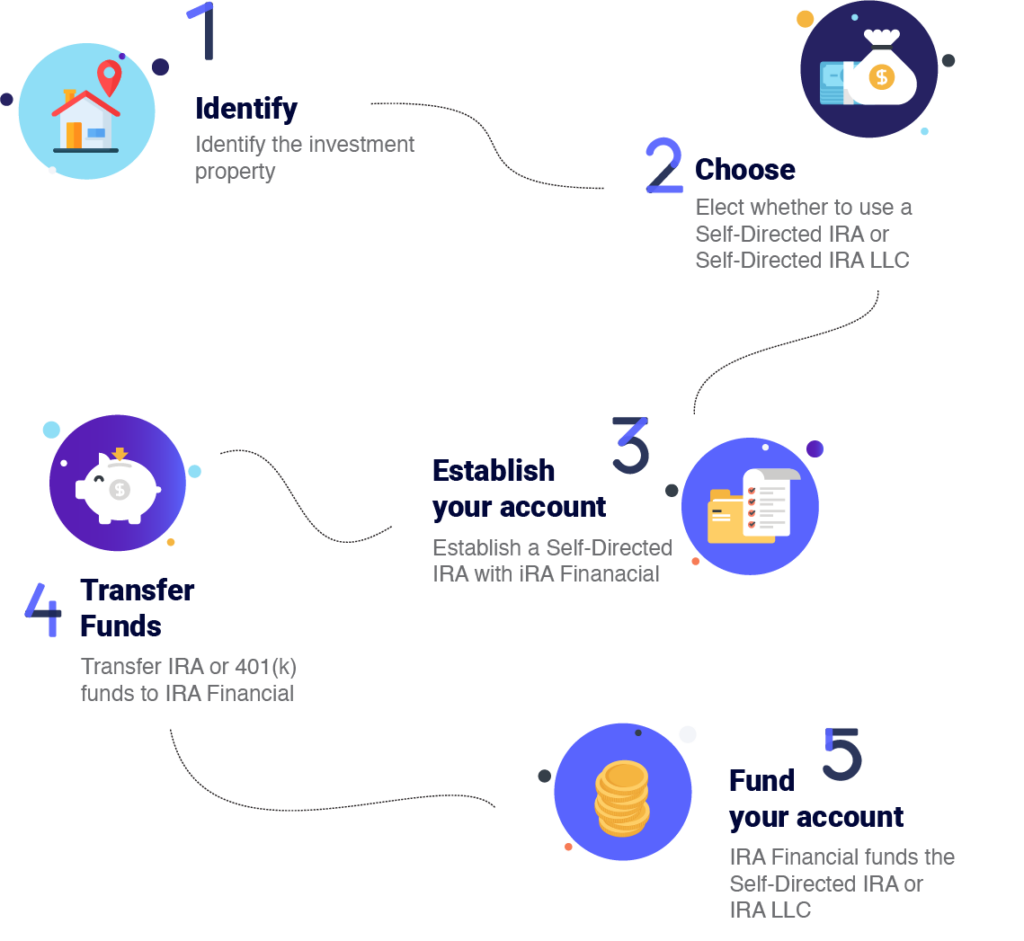

How to Buy Real Estate in an IRA

With IRA Financial. you can easily and quickly establish your Self-Directed IRA/IRA LLC to make real estate investments. It only takes five simple steps:

- 1. Identify the investment property

- 2. Elect whether to use a Self-Directed IRA or Self-Directed IRA LLC

- 3. Establish a Self-Directed IRA with IRA Financial

- 4. Transfer IRA or 401(k) funds to IRA Financial

- 5. IRA Financial funds the Self-Directed IRA or IRA LLC

Real estate is one of the most popular retirement investments among self-directed investors. One primary reason is that real estate is a tangible asset that produces steady income. For many investors, particularly those with real estate experience, it has been an integral investment in building retirement wealth. But did you know that with a Self-Directed IRA for Real Estate you are not limited to real estate investments? Instead you can diversify your portfolio by investing in both traditional and alternative investments.

Learn More: Alternative Investments in an IRA

Savvy Strategies for Using Your Self-Directed IRA to Purchase

Real Estate

If you have enough funds in your Self-Directed IRA to cover the entire real estate purchase (including closing costs, taxes, fees, insurance, etc.) you may make the purchase outright using your Self-Directed IRA. The real estate investment can made via a full-service self-directed IRA or a self-directed IRA LLC. All income or gains relating to your real estate investment must return to your Self-Directed IRA.

Learn More: What is a Self-Directed IRA LLC?

If you don’t have sufficient funds in your Self-Directed IRA to make a real estate purchase outright, your Self-Directed IRA can purchase an interest in the property along with a family member who is a non-disqualified person. You can also purchase with a friend, or colleague. The investment will not be made into an entity owned by the IRA owner. Instead, it’s invested directly into the property.

For example, your Self-Directed IRA can partner with a non-disqualified family member, friend, or colleague to purchase a piece of property for $150,000. Your Self-Directed IRA can purchase an interest in the property (for example, 50% for $75,000) and your family member, friend, or colleague can purchase the remaining interest (50% for $75,000).

All income or gain from the property will allocate to the parties in relation to their percentage of ownership in the property. Likewise, all property expenses must be paid in relation to the parties’ percentage of ownership in the property.

Based on the above example, for a $2,000 property tax bill, the Self-Directed IRA will be responsible for 50% of the bill ($1,000). The family member, friend, or colleague is then responsible for the remaining $1,000 (50%).

Nonrecourse Loan

One question we are frequently asked is, “Can an IRA get a mortgage or loan?” A real estate IRA or Self-Directed IRA can absolutely get a loan. The process of qualifying for a loan inside an IRA is called non-recourse financing.

A nonrecourse loan is a loan that is not personally guaranteed by the borrower. In the case of a self-directed IRA, IRC 4975(c) does not allow an IRA owner to personally guaranty an obligation of an IRA, This is the reason why an IRA can only use a nonrecourse loan to acquire real estate.

Because a nonrecourse loan does not include a personal guaranty, the lender is essentially taking on a greater level of risk. The only recourse the lender would have for a default in payment is to take back the underlying property since there is no personal guaranty. Hence, most nonrecourse lenders will require a higher level of equity, technically at least 30%. In addition, the interest on the loan is typically higher on a nonrecourse loan.

UBIT

In general, when it comes to using a retirement account to make investments most investments are exempt from federal income tax. This is because a retirement account is exempt from tax pursuant to IRC Sections 401 and 408. IRC Section 512 of the Internal Revenue Codes exempt most forms of investment income generated by an IRA from taxation. Some examples of exempt type of income include interest from loans, dividends, annuities, royalties, most rentals from real estate, and gains/losses from the sale of real estate. Whereas the type of income that generally could subject a retirement account to UBTI is income generated from the following sources:

- Income from the operations of an active trade or business – i.e. a restaurant, gas station, store, etc.

- Business income generated via a passthrough entity, such as an LLC or partnership

- Using a nonrecourse loan to purchase a property (in the case of an IRA)

- Using margin on a stock purchase

When a debt-financed asset is sold, a special rule applies for the purpose of calculating the taxable gain. In general, the IRA would be subject to a UBIT tax of up to 37% on the debt financed portion of the income or gains attributable the loan above $1000. The UBIT taxed is paid by the IRA on form 990-T. IRA financial will assist the IRA owner in completing and filing IRS Form 990-T.

Note – there are several ways to reduce the impact of the UB IT tax, such as a C Corporation blocker. IRA Financial has significant experience in structuring self-directed IRA real estate transactions that minimize the application of the UBIT tax.

Conclusion

Real estate is the most popular investment for self-directed IRA investors. The use of a special purpose LLC to hold the real estate has proven to be an attractive option for investors looking to gain limited liability protection and greater control over their real estate investment. The ability to invest in a hard asset that provides investment diversification makes real estate such an attractive investment asset category. In addition, the ability to generate tax-deferred or tax-free income or gains in the case of a Roth IRA is the reason the self-directed IRA is such an attractive vehicle for owning real estate

To learn more, please contact a Solo 401(k) plan specialist at 800-472-0646.