Roth Solo 401(k)

A Roth Solo 401(k) is a tax-advantageous retirement plan for self-employed individuals and small business owners.

The Roth Solo 401(k)

Back in 2006, Congress put into law the Roth 401(k). This gave 401(k) plans the same benefits as the already-established Roth IRA. Five years prior, the Economic Growth and Tax Relief Reconciliation Act of 2001 made it so self-employed individuals could start their own 401(k) plan.

This became popularly known as the Solo 401(k) or Individual 401(k) retirement plan. Merge the two to get the Roth Solo 401(k).

Here, we’ll talk about the Solo Roth 401(k) benefits for small business owners (and self-employed individuals).

Key Points

- The Roth Solo 401(k) is the best retirement plan for the self-employed

- The Roth Solo 401(k) allows for qualified tax-free withdrawals

- Opening a Roth Solo 401(k) will allow you to save more for retirement and invest in traditional & alternative investments.

Roth Solo 401(k) Eligibility Requirements

To be eligible for any type of Solo 401(k) plan, you must adhere to two rules. First, you must have self-employment income. This income can either come from a business you own or from so-called “gig” jobs.

Gigs can vary from consulting jobs to freelancing to Uber driving.

The second eligibility requirement is the absence of full-time employees (other than a spouse or business partner). You can have contract workers and part-timers work for your business. However, any employee over age 21 who works more than 1,000 hours during the year, becomes eligible for the 401(k) plan. You can no longer utilize a Solo 401(k) if and when this happens.

Roth Solo 401(k) Benefits

The Roth Solo 40(k) is the best retirement plan for self-employed and small business owners. With the potential increase of federal and state income tax rates, the ability to generate tax-free returns from your IRA investments is the last surviving legal tax shelter.

With this plan, you can make almost any type of investment tax-free. This includes real estate, tax liens, precious metals, and more. You can also continue to make traditional investments, like stocks, bonds, and mutual funds. When you reach age 59 1/2, you’ll have the ability to live off your Roth 401(k) assets without having to pay tax.

Look at the Roth Solo 401k this way: if you start contributions in your 40s and generate a modest rate of return, you may have over $1 million tax-free when you retire. With a Solo Roth 401(k), you have options. A Solo Roth 401(k) has the following benefits:

- Solo 401(k) benefits

- High contributions

- Ability to invest in asset classes you know

- Designed specifically for you – self-employed and small business owners

- Tax- and penalty-free loan

- Roth IRA benefits

- Tax-free gains when you take a qualified distribution

- Helps diversify tax payments

Roth Solo 401(k): Tax-Free Investing

The individual retirement plan offers many advantages to self-employed individuals and small business owners. Most notable is the power of tax-free investing. Tax-free investing means that all qualified distributions to a Roth Solo 401(k) account are tax-free. In other words, you don’t have to pay tax on distributions received. All income and gains you generate are not tax deductible.

One of the main attractions is the fact that qualified distributions of Roth earnings are tax-free. With it, you never have to pay tax on distributions received.

When you contribute to the plan, all income and gains the Roth 401(k) investment generates are tax-free. Unlike contributions with a pretax Solo 401(k) plan, contributions to a Roth Solo 401(k) are not tax deductible.

Take a look at the following examples to better understand the power of tax-free investing:

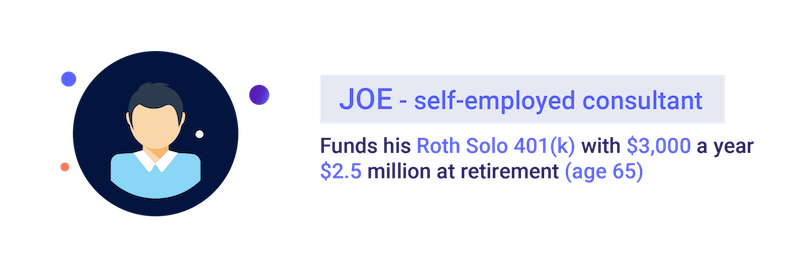

Joe is a self-employed consultant who began funding his Roth Solo 401(k) plan at age 20. He contributed $3,000 annually and until age 65. At 65, he has $2.5 million at retirement. This is assuming he earns the long-run annual compound growth rate in stocks which was 9.88 percent from 1926-2011. Not a bad result for investing only $3,000 a year.

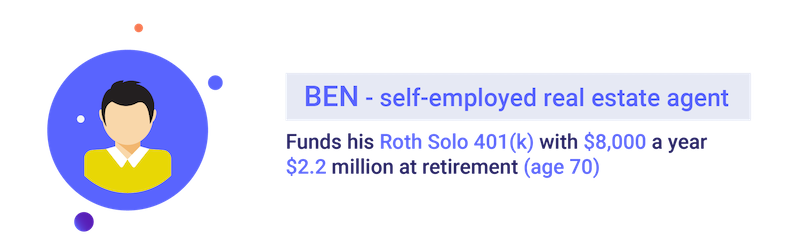

Ben is a self-employed real estate agent who began funding his Plan at age 30. His annual contributions were $8,000 at an 8% rate of return on his investments. After researching, he realized that he would make a whopping $2,238,248 at age 70. He can live off this money or pass it to his wife and children, tax-free.

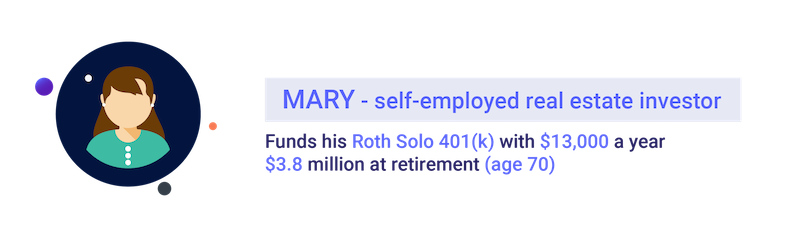

Mary is a self-employed real estate investor who is 35 years old. She began funding a Roth Solo 401(k) plan with $13,000 annually and wanted to know how much she would have at age 70. If she could make a 10% rate of return (which she believes is possible with her real estate investment returns), at age 70, she would have $3,875,649 tax-free.

Benefits of a Roth Solo 401(k)

- Higher Contributions with a Roth Solo 401(k)

A Roth Solo 401(k) has all the attractive features of a traditional 401(k) with the features of a Roth IRA. Like a Solo 401(k) Plan, it is perfect for anyone who earns self-employment or small business owners with no employees, or an individual who earns self-employment income, the Roth Solo 401(k) is a wonderful retirement solution.

A Roth 401(k) account grows tax-free and withdrawals taken during retirement are not subject to income tax. However, you must be at least 59 1/2 and have the account for five or more years.

If you’re self-employed, you can use the Roth Solo 401(k) to maximize your ability to generate tax-free retirement savings and invest in alternative assets, like real estate without custodian consent.

Unlike a Roth IRA, which limits Roth IRA contributions to $7,000 annually ($8,000 if you’re age 50 or older) in 2024, the Roth Solo 401(k) account allows after-tax employee contributions of up to $23,000. If you’re 50 or older, you can make up to $30,500 in contributions. Now, thanks to SECURE Act 2.0, employer profit-sharing contributions can be made as Roth. This brings the total Roth contribution limit for 2024 to $69,000 or $76,500 if age 50 or above. This allows you to accumulate tens of thousands more in tax-free retirement than a Roth IRA.

The high contribution limits for a Roth Solo 401(k) allow you to invest faster. Imagine if an IRA was your only retirement savings vehicle. It would take you almost ten years(!) to contribute the same amount as with a Solo 401(k).

Read This: Not All Solo 401(k) Plans Are The Same

- Unlimited Investment Opportunities

- Roth Solo 401(k) Loan Feature

With a Roth 401(k) plan or Roth 401(k) plan sub-account, you can invest your after-tax funds in:

The list of alternative asset investments doesn’t stop there. Compared to a pretax 401(k) plan, a Roth Solo 401(k) or Roth 401(k) retirement plan offers a tax-free source. This will become beneficial if federal income tax rates increase. The ability to have a tax-free source of income upon retirement may be the difference between early retirement, or not.

Learn More: Most Popular Solo 401(k) Investments

While an IRA offers no participant loan feature, the Roth Solo 401k allows participants to borrow up to $50,000 or 50% of their account value (whichever is less). You can use this loan for any purpose at a low-interest rate.

This offers participants the ability to access up to $50,000 to use for any purpose, including paying personal debt or funding a business.

*Did you know that not all Solo 401(k) plans come with a loan feature? While IRA Financial offers this feature with all Solo 401(k) plans, some providers do not offer a loan feature.

Learn More: Solo 401(k) Loan

- Exempt From UDFI

- Cost Effective Administration

The primary advantage of using a Roth 401(k) to make investments is that in almost all cases income and gains allocated to the Roth would be tax-free. In addition, so long as one is over the age of 59 1/2 and the Roth owner is over the age of 59 1/2, all Roth 401(k) distributions would be tax-free. However, if the Roth 401(k) engaged in certain activities that triggered a little-known tax called the Unrelated Business Taxable Income tax (UBTI or UBIT), then a maximum tax of approximately 37% for 2024 could apply.

Learn More: Understanding the UDFI Exemption

Because the plan is a Solo 401(k), it’s easy to operate. There is generally no annual filing requirement unless your solo 401(k) plan exceeds $250,000 in assets. In that case, you simply have to file a short information return with the IRS (Form 5500-EZ).

Is the Roth Solo 401(k) Plan Right for You?

We can’t speak for all small business owners/self-employed individuals, but the Roth Solo 401(k) might be the best plan out there.

- High Contribution Limits?

- Tax-Free Distributions?

- Alternate Asset Investing?

- Diversity?

The Roth Solo 401(k) retirement plan certainly seems to check all the appropriate boxes. When combined, you certainly grow your retirement faster.

Conclusion

The Roth Solo 401(k) strategy is a great way to maximize one’s Roth contributions and gain investment control. Not all Roth Solo 401(k) plans include a loan feature. For example, a Solo 401(k) plan offered by a brokerage firm will typically not include the option. IRA Financial is one of the few Solo 401(k) plan providers that allows for this amazing tax planning tool.

Below is a summary of how the mega backdoor Roth Solo 401(k) works:

-

Establish a Solo 401(k) plan.

Must be self-employed or have a small business with no full-time employees. Also, must confirm that the plan allows for after-tax contributions.

-

Make after-tax contributions.

To the Solo 401(k) plan up to $69,000 ($76,500 if at least age 50) in 2024. Contributions can be made dollar-for dollar. Just make sure you have sufficient earned income (Schedule C or W-2). Passive income, such as rental income, capital gains, interest is not eligible for plan contributions.

-

Begin Investing

After making contributions or rolling over your retirement funds, investing becomes as easy as writing a check.

To learn more, please contact a Solo 401(k) plan specialist at 800-472-0646.