Discover how the ROBS 401(k) works

- The only legal way to invest in a business you will work at with retirement funds

- Use IRA or 401(k) funds with no tax or penalty

- Exempted from the IRS prohibited transaction rules

- Invest in yourself

- Earn a salary

- Gain investment diversification

- Generate tax-free gains from the sale of the business

INTERESTED IN LEARNING MORE?

Complete the form, and our expert will reach out to you soon.Our business hours are 9AM – 7PM EDT, M-F.

Read our Privacy Policy.

Save Money

The ROBS Solution is the only legal solution that will allow you to invest your retirement funds in a business you will be personally involved in without having to pay tax and or penalty on a retirement account distribution.

Invest in Yourself

The ROBS solution allows you to invest your retirement funds in a business that will be actively run by you or a family member. As a result, you’re investing retirement funds in yourself rather than in Wall Street.

Earn a Salary

To be a participant of a 401(k) plan, you need to be an employee of the business that adopted the plan. For many entrepreneurs, the ability to earn a salary is the reason they chose ROBS over the Self-Directed IRA.

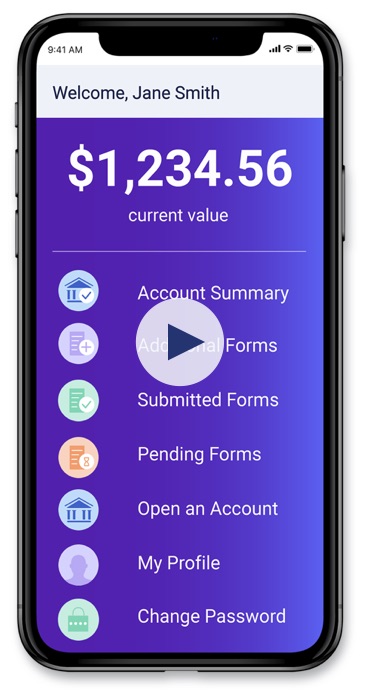

How it works

1. Establish a C Corp.

Establish a new C Corporation in the state the business will be operating. It must be a C corporation.

2. The C Corp. adopts a 401(k).

The C Corporation adopts a prototype 401(k) plan, letting participants direct their plans’ investments, including employer stock or “qualifying employer securities.”

3. Participate in the 401(k)

You elect to participate in the new 401(k) plan, then direct a rollover of a prior employer’s 401(k) plan funds into the newly adopted plan.

4. Purchase stock

Using your 401(k), purchase the C Corporation’s newly issued stock at fair market value.

5. The C Corp. purchases assets

The C Corporation uses the proceeds from the sale of stock to purchase the assets for the new business.

6. Earn a salary

Now you can earn a salary from the revenue of the business and personally guarantee any business loan.

How we’re different

Experience

Our tax and ERISA experts have helped over 24,000 clients invest $3.2 billion in alternative assets.

Prestige

Our founder, Adam Bergman, was a tax lawyer and is the author of 8 books on self-directed retirement plans.

Dedicated Support

In addition to tons of online resources, IRA Financial gives clients access to experienced specialists dedicated to your peace of mind.