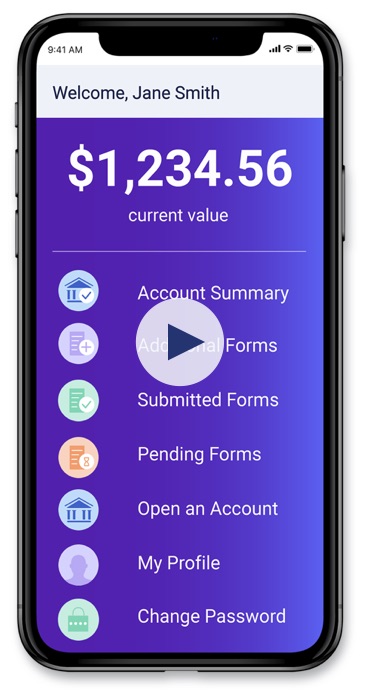

Take control of your retirement funds with a Checkbook IRA LLC

- Invest in alternative assets on your own

- Get limited liability protection

- No transaction fees

- More control and custodian is less involved

- Great for high activity transactions, such as most real estate investments

- No more custodian delays

- Flat annual fees with no asset valuation fees

Interested in learning more?

Complete the form, and our expert will reach out to you soon.

Our business hours are 9AM – 6PM EST, M-F.

Read our Privacy Policy.

Advantages of the Checkbook IRA LLC

Checkbook Control

As manager of the IRA LLC, you will have the ability to make IRA investments without seeking the consent of a custodian.

Access & Speed

The Self-Directed IRA LLC gives you direct access to your IRA funds so you can invest quickly and efficiently. There’s no need for custodian approval, delays, or review fees.

Flat Fees

Invest in alternative assets for a low flat annual fee with no transaction or asset value fees. No minimum balance (with credit card on file) or account termination fees.

Limited Liability

Invest your IRA in alternative assets with limited liability protection. This means IRA assets held outside the LLC will be shielded from attack.

Asset & Creditor Protection

Your IRA will be protected for up to $1.3 million in the case of personal bankruptcy. In addition, most states will shield a Self-Directed IRA from creditor attack against the holder outside of bankruptcy.

Tax-Free Income & Gains

Take advantage of the power of tax deferral and compounding interest by using a Self-Directed IRA to invest. All income and gains generated will be tax deferred (or tax free in the case of a Roth IRA).

How Does It Work?

1. Transfer your funds to a passive custodian tax free

Your retirement funds are transferred from your current custodian to a passive custodian like IRA Financial.

2. Establish an LLC and transfer your funds to its account

You can serve as manager of your established LLC. IRA Financial opens your LLC bank account at Capital One then transfers your retirement funds into that new account.

3. Get checkbook control and invest in alternative assets

As manager, you have checkbook control and can direct the LLC to invest in real estate, tax liens, private businesses, metals, and more.

Why We’re Different

Experience

Our tax and ERISA experts have helped over 24,000 clients invest $3.2 billion in alternative assets.

Prestige

Our founder, Adam Bergman, was a tax lawyer and is the author of nine books on self-directed retirement plans.

Dedicated Support

In addition to tons of online resources, IRA Financial gives clients access to experienced specialists dedicated to your peace of mind.