A Self-Directed account in the retirement account world can mean a Self-Directed IRA or a Self-Directed Solo 401(k) plan. This article will examine the key details surrounding both the Self-Directed IRA and the Self-Directed Solo 401(k).

What is a Self-Directed Account?

A Self-Directed IRA is not a legal term that you will find in the Internal Revenue Code. A Self-Directed IRA is essentially an IRA that allows for alternative asset investments, such as real estate or even cryptocurrency. Traditional financial institutions do not allow IRAs to invest in IRS-approved alternative assets, such as real estate, because their focus is on earning fees through traditional investments. Hence, the birth of the Self-Directed IRA industry. Today, the Retirement Industry Trust Association (RITA) estimates anywhere between 4-7% of all IRAs are invested in alternative assets. Accordingly, the Self-Directed IRA is the only way one can purchase alternative assets in an IRA.

How Does the Self-Directed IRA Work?

With a Self-Directed IRA, a special IRA custodian, IRA Financial, will serve as the custodian of the IRA. All types of IRAs can be used in a Self-Directed IRA structure, such as a Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, 401(k) rollover, and even a Coverdell and HSA.

Unlike a typical financial institution which generates fees by selling products and providing investment services, a Self-Directed IRA custodian earns fees by simply opening and maintaining IRA accounts and does not offer any financial investment products or platforms. With a Self-Directed IRA, the IRA funds are generally held with the IRA custodian. The IRA owner will then direct the IRA custodian to invest the IRA funds in IRS-approved alternative asset investments, such as real estate. Title to the Self-Directed IRA asset will be in the name of the Self-Directed IRA custodian care of the IRA owner.

A Self-Directed IRA is popular with retirement investors looking to invest in alternative assets that do not involve a high frequency of transactions, such as the purchase of raw land or private fund investments.

Types of Self-Directed Accounts

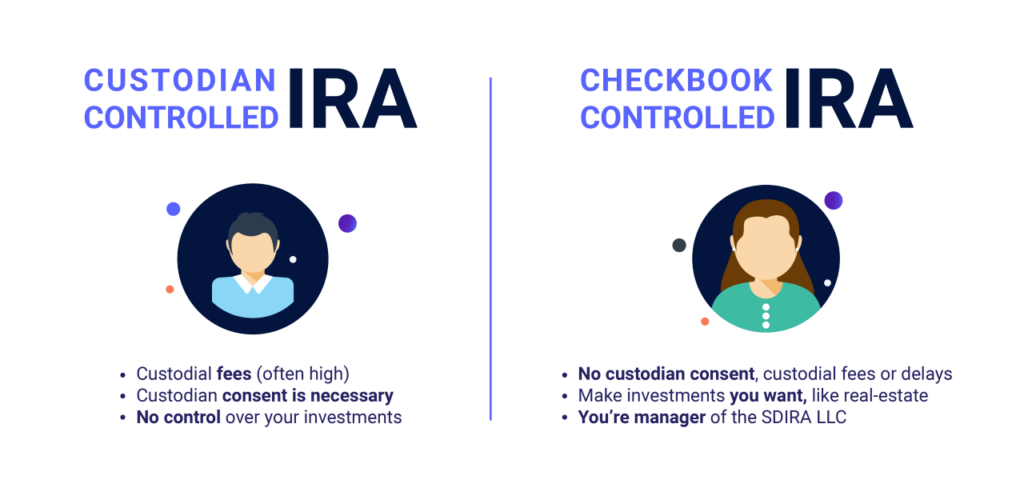

The two primary options for using a Self-Directed IRA to make alternative asset investments are the (i) full-service Self-Directed IRA and (ii) the Self-Directed IRA with “checkbook control.”

Self-Directed IRA Account Full Service

With a full-service Self-Directed IRA, a special IRA custodian, IRA Financial, will serve as the custodian of the IRA. Unlike a typical financial institution which generates fees by selling products and providing investment services, a Self-Directed IRA custodian earns fees by simply opening and maintaining IRA accounts and does not offer any financial investment products or platforms.

With a full-service Self-Directed IRA, the IRA funds are generally held with the IRA custodian. The IRA owner will then direct the IRA custodian to invest the IRA funds in IRS-approved alternative asset investments, such as real estate. Title to the Self-Directed IRA asset will be in the name of the Self-Directed IRA custodian care of the IRA owner. For example: IRA Financial Trust Company CFBO John Doe IRA.

A Self-Directed IRA that is full-service is popular with retirement investors looking to invest in alternative assets that do not involve a high frequency of transactions, such as the purchase of raw land or private fund investments.

Self-Directed IRA Account “Checkbook Control”

With a Self-Directed IRA with checkbook control, an IRA is set-up with a Self-Directed IRA custodian, such as IRA Financial. The IRA is then invested into a special purpose limited liability company (“LLC”), which IRA Financial can help you establish. The Self-Directed IRA LLC is then managed by the IRA owner providing the IRA owner with “checkbook control” over the IRA funds. With a “checkbook control” Self-Directed IRA LLC, the manager of the Self-Directed IRA LLC will have the authority to make investment decisions without the involvement of the custodian. Plus, a Self-Directed IRA LLC will offer the IRA owner limited liability protection over IRA investments. Moreover, all Self-Directed IRA investments will be titled in the name of the LLC offering the IRA owner more privacy. With a Self-Directed IRA LLC with “Checkbook Control’ you will be able to buy real estate by simply writing a check.

All types of IRAs can be transferred tax-free to a Self-Directed IRA LLC. A Self-Directed Roth IRA with “checkbook control” is popular with IRA investors seeking to invest in alternative assets, such as rental properties, fixes, and flips, tax liens, or cryptocurrencies that require a high frequency of transactions.

Why Set Up a Self-Directed IRA

The Self-Directed IRA is the most popular Self-Directed retirement solution. A Self-Directed IRA is the perfect retirement or investment vehicle for anyone looking to use their IRA funds to invest in non-publicly traded securities. The primary advantages of using a Self-Directed IRA are you gain the ability to invest in almost anything you want, diversify your retirement assets, hedge against inflation, plus generate income and gains tax-free.

The Self-Directed Solo 401(k)

A Solo 401(k) plan is not a new type of retirement plan. It is a traditional 401(k) plan covering only one employee. In general, to be eligible to establish a Solo 401(k) plan, one must be self-employed or have a small business with no full-time employees (over 1000 hours during the year) other than a spouse or other owner(s).

As the name implies, the Solo 401(k) plan is an IRS-approved qualified 401(k) plan designed for a self-employed individual or the sole owner-employee of a corporation. It works best when there are no other employees or a very small number of employees.

Unlike a Solo 401(k) plan that can be opened at a traditional financial institution, a Self-Directed Solo 401(K) plan allows one to invest in alternative assets and not just stocks, just like a Self-Directed IRA.

How Does the Solo 401(k) Plan Work

The Solo 401(k) plan documents essentially control what a Solo 401(k) plan can invest in. Not all Solo 401(k) plans are the same. For example, only a Self-Directed Solo 401(k) plan will allow you to buy alternative assets, such as real estate with your plan funds. Whereas, a Solo 401(k) plan provided by a traditional financial institution, such as Vanguard, would not permit the plan to invest in alternative assets, such as real estate/

When it comes to making investments with a Self-Directed Solo 401(k) account, the IRS generally does not tell you what you can invest in, only what you cannot invest in. The types of investments that are not permitted to be made using retirement funds is outlined in Internal Revenue Code Sections 408 and 4975. These rules are generally known as the “Prohibited Transaction” rules. Other than collectibles, and transactions that involve or directly or indirectly benefit the plan participant or a “disqualified person,” one can use their 401(k) to make the investments. A “disqualified person” is generally defined as the plan participant and any of his or her lineal descendants and/or any entities controlled by such persons.

Hence, so long as the Self-Directed Solo 401(k) account plan documents allow for real estate investments and the real estate investment does not directly or indirectly benefit a “disqualified person,” real estate is a permissible Solo 401(k) investment.

Why Should I Set Up a Solo 401(k) Account?

To be eligible to benefit from the Solo 401(k) plan, investors must meet just two eligibility requirements:

- The presence of self-employment activity.

- The absence of full-time employees.

Hence, anyone with a part-time or full-time business, whether it is sole proprietorship, LLC, or corporation, with no full-time employees (over 1000 hours or 500 hours for 3 consecutive years) that are not owners of the business or their spouses, would generally be eligible to establish a Self-Directed Solo 401(k) account.

The following are the key reasons why the Self-Directed Solo 401(k) account is the most popular retirement plan for the self-employed or small business owner.

High Contribution Limits

With a Self-Directed Solo 401(k) Plan account, in 2025, a plan participant can make annual contributions up to $70,000 annually with an additional $7,500 catch-up contribution for those age 50 and older. Plus, if you are between the ages of 60 and 63, the catch-up contribution increases to $11,250.

Under the 2025 Solo 401(k) contribution rules, a plan participant under the age of 50 can make a maximum annual employee deferral contribution of $23,500 ($23,000 for 2024). That amount can be made in pretax, after-tax, or Roth. On the profit-sharing side, the business can make a 25% (20% in the case of a sole proprietorship or single member LLC) annual profit-sharing contribution based on the amount of the net Schedule C amount or W-2, as applicable, up to a combined maximum, including the employee deferral, of $70,000 in 2025.

For plan participants aged 50 and older, an individual can make a maximum annual employee deferral contribution of $31,000 for 2025. That amount can be made in pretax, after-tax, or Roth. On the profit-sharing side, the business can make a 25% (20% in the case of a sole proprietorship or single member LLC) annual profit-sharing contribution based on the amount of the net Schedule C amount or W-2, as applicable, up to the maximum.

The Self-Directed Solo 401(k) account can help business owners generate tax deductions as well as sock away a significant amount of money each year.

Loan Feature

A 401(k) loan is permitted at any time using the accumulated balance of the plan. Internal Revenue Code Section 72(p) and the 2001 EGGTRA rules allow a plan participant to borrow money from the plan tax free and without penalty. As long as the plan documents allow for it and the proper loan documents are prepared and executed, a participant loan can be made for any reason.

A Self-Directed Solo 401(k) participant can borrow up to $50,000 or 50% of their account value – whichever is less. This loan has to be repaid over an amortization schedule of five years or less with a payment frequency no greater than quarterly. The interest rate must be set at a reasonable rate of interest, generally interpreted as the prime rate as per the Wall Street Journal. As of January 1, 2025, the prime rate is 7.5%, which means participant loans may be set at a very reasonable Interest rate. The Interest rate is fixed based on the prime rate at the time of the loan application.

Read More: Solo 401(k) Loan

“Checkbook Control”

One of the most popular features of the Self-Directed Solo 401k Plan is that it does not require the participant to hire a bank or trust company to serve as trustee. This flexibility allows the plan participant (you) to serve in the trustee role. This means that all assets of the Self-Directed 401(k) account are under the sole authority of the Solo 401k participant. In addition, with a “checkbook control” Self-Directed Solo 401(k) account, you have the ability to invest in traditional as well as alternative assets, such as real estate. A Self-Directed Solo 401(k) plan allows you to eliminate the expense and delays associated with an IRA custodian, enabling you to act quickly when the right investment opportunity presents itself. Making a Self-Directed Solo 401(k) account investment is as simple as writing a check.

Related: Solo 401(k) with Checkbook Control

Flexible Contribution Options

With a Self-Directed Solo 401(k) account, contributions are completely discretionary. You always have the option to try to contribute as much as legally possible, but you always have the option of reducing or even suspending plan contributions if necessary.

Roth-Type Contributions

The IRA Financial Self-Directed Solo 401(k) account contains a built-in Roth sub-account which can be contributed to without any income restrictions. In addition, our Self-Directed Solo 401(k) account allows you to take advantage of the “mega backdoor Roth” option allowing you to reach your maximum contribution limit quicker all in Roth. The Solo 401(k) “mega backdoor Roth” option is the ultimate Roth solution.

The “Backdoor Roth Solo 401(k)” strategy is simple to do. Simply contribute to the Solo 401(k) plan up to $70,000 in 2025. After-tax contributions are one of the few exceptions to the prohibition on in-plan service distributions. In both options, one will be able to get up to the annual limit to a Roth 401(k) or Roth IRA via the Backdoor Roth Solo 401(k) strategy.

In other words, after-tax 401(k) contributions are not treated as employee deferral or employer profit-sharing contributions and can be made on a dollar-for-dollar basis. For example, a self-employed individual over the age of 50 who makes $70,000 would be able to contribute $31,000 as an employee deferral, in pretax or Roth, and 20% of his or her compensation or $14,000 as a pretax employer profit-sharing contribution, providing her with an aggregate plan contribution of $45,000 for the year.

Whereas if the individual employed the Backdoor Roth Self-Directed Solo 401(k) strategy, he or she would be able to contribute the entire $70,000 to the plan and immediately convert the funds to Roth and roll them over to a Roth IRA without tax.

Cost Effective Administration

The Self-Directed Solo 401(k) account is easy to operate and effortless to administer. There is generally no annual filing requirement unless your Solo 401(k) Plan exceeds $250,000 in assets, in which case you will need to file a short information return with the IRS (Form 5500-EZ).

Secret Weapon for Real Estate Investors

Pursuant to Internal Revenue Code Section 514, a 401(k) account is not subject to the unrelated business taxable income tax (UBTI) on the use of a non-recourse loan (leverage) in connection with the purchase of real estate. An IRA that uses leverage to purchase real estate would be subject to the UBTI on the debt-financed portion of the property. The current maximum UBTI tax rate is 37%.

Tax-Deferred or Tax-Free Gains

In general, all income and gains generated from a 401(k) account will flow back to the plan without tax. That means you will pay no tax on any income or gains earned by your plan investments while they are held inside the account. Traditional plan withdrawals are subject to tax, while qualified Roth withdrawals are not.

Conclusion

Over the last several years, the self-directed account has become an increasingly popular vehicle for retirement account investors looking to gain more investment freedom and greater retirement tax savings. In addition, a self-directed account is the perfect retirement or investment vehicle for anyone looking to use their retirement funds to invest in non-publicly traded securities. The primary advantage of using a Self-Directed Solo 401(k) is that the account owner gains the ability to invest in almost anything they want, better diversify their retirement assets, hedge against inflation, plus generate income and gains without tax.