Solo 401(k)

The best retirement plan for the self-employed or small business owner with no full-time employees.

What is a Solo 401(k)?

A Solo 401(k) is a retirement plan specifically designed for self-employed individuals. A solo 401(k) plan is not a new type of retirement plan. A solo 401(k) plan is essentially a 401(k) plan designed for a business with no full-time employees other than the owners and/or their spouses. Also known as a one participant 401(k), it works the same as an employer-sponsored plan, but with greater flexibility. To be eligible, you need to satisfy two requirements: the presence of self-employment activity and the lack of full-time employees. You can make contributions as both an employee and employer. Any business with no full-time employees other than the owners or their spouses can establish a solo 401(k), such as a sole proprietor, LLC, C Corporation, S Corporation, partnership, or even a charity.

Solo 401(k) Benefits

Maximize Contributions

Make annual contributions up to $69,000 or $76,500 if age 50 or older in Roth, pretax, or after-tax.

Borrow up to $50,000

Borrow up to $50,000 or 50% of your account value (whichever is less) and use your Solo 401(k) loan for any purpose.

Get Checkbook Control

Serve as trustee of your plan and make alternative asset investments on your own with checkbook control.

Hassle-Free Administration

Easy to operate and administer. There’s generally no annual filing requirement unless your account exceeds $250,000 in assets.

No Hidden Fees

Invest for one low flat fee, with no transaction fees, asset valuation fees, or minimum balance requirement.

Real Estate Investor Bonus

Leverage your 401(k) plan to invest in real estate and pay no UBTI tax.

The IRA Financial Difference

24,000+ clients

Our tax and ERISA experts have helped over 24,000 clients in all 50 states.

No hidden fees

No transaction or asset value fees. No minimum balance requirement (with credit card on file).

Serve as your custodian

Hold over $3.2 Billion in alternative assets.

Expertise

IRA Financial’s founder, Adam Bergman, is the author of eight books on self-directed retirement.

Dedicated support

Get direct access to a self-directed retirement expert to establish your plan.

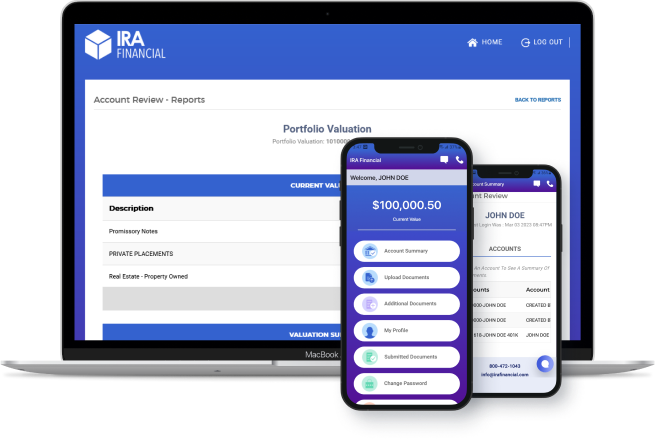

Technology

Use our app to set-up and maintain your account.

Open a Solo 401(k)

Complete your application

Once completed, it will go into a queue to be reviewed (generally, 3-5 days).

Application is reviewed

Your application is reviewed to ensure everything is filled out correctly

Account number assigned

Once your application is approved, an account number is assigned and emailed to you (an additional 3-5 days).

Fund your account

You can now fund your Solo 401(k) via transfer, rollover, or direct contribution.

Start investing

Once your 401(k) is funded, you can begin making investments!

Endless investments opportunities.

Real Estate

Whether it’s residential or commercial, rental properties or raw land, real estate is the #1 alternative investment among retirement investors.Precious Metals

Metals Metals and coins have long been used as a hedge against a volatile economy – just make sure they are IRS-approved precious metals and not held personally.Private Placements

Placements Investment opportunities offered to a select group of high net worth or institutional investors that have reduced risk and assured returns.

Tax Liens/Deeds

Tax liens and deeds allow for exposure to the real estate market in your portfolio without having to invest in the properties themselves.Investment Funds

Hedge funds and private equity fund investments are generally for more sophisticated, accredited investors.

Quick FAQ & Further Reading

Contribution limits for a Solo 401(k) plan in 2024 are as follows:

2023: Employee Deferrals Under 50: $22,500

2024: Employee Deferrals Under 50: $23,000

2023: Employee Deferrals Over 50: $30,000

2024 – Employee Deferrals Over 50: $30,500

2023 Max Aggregate Contribution Amount (Employee Deferrals + Employer Contributions) Under50: $66,000

2024 Max Aggregate Contribution Amount (Employee Deferrals + Employer Contributions) Under50: $69,000

2023 Max Aggregate Contribution Amount Employee Deferrals + Employer Contributions) Over 50: $73,500

2024 Max Aggregate Contribution Amount Employee Deferrals + Employer Contributions) Over 50: $76,500