What is a Self-Directed IRA?

A Self-Directed IRA is a retirement account that allows you to invest in traditional and alternative investments. Frequently, large financial institutions that manage retirement accounts limit investment opportunities to stocks, bonds, and mutual funds. A Self-Directed IRA allows you to invest in almost anything. In fact, there are only three things you cannot invest in life insurance, collectibles, and transactions with a disqualified person.

The Self-Directed IRA

Since the creation of IRAs in 1974, alternative investments, such as real estate, have always been permitted to be invested by IRAs. But few people seemed to know about this option until the last several years. So why can’t you invest your IRA in alternative assets at a bank or traditional brokerage firm?

Not surprisingly, the answer comes down to money. Traditional brokerage firms make money and fees on your cash and from selling traditional investments, like stocks, mutual funds, and ETFs. They do not generate any revenues or profits when your IRA invests in alternative investments, such as real estate. Hence, it is not in their financial interest to publicize the fact that the IRS allows all IRAs to invest in alternative assets, such as real estate, precious metals, cryptocurrencies, private placements, and much more

A Self-Directed IRA is a retirement account that allows you to invest in traditional and alternative investments. Frequently, large financial institutions that manage retirement accounts limit investment opportunities to stocks, bonds, and mutual funds. A Self-Directed IRA allows you to invest in almost anything. There are only three things you cannot invest in life insurance, collectibles, and transactions with a disqualified person.

Many investors open a Self-Directed IRA to diversify their retirement funds.

Key Points

- A Self-Directed IRA is a retirement account that allows you to invest in traditional and alternative investments.

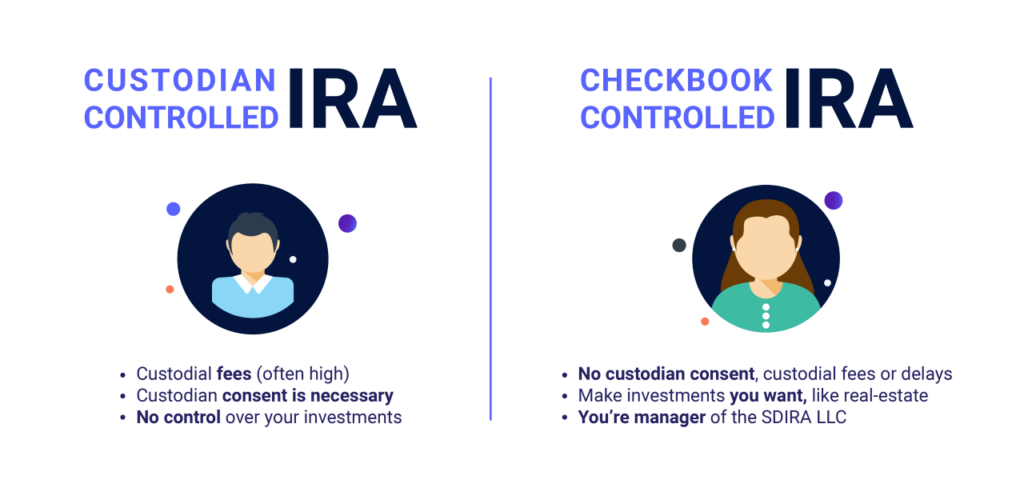

- A Self-Directed IRA can be a custodian controlled IRA or a checkbook control IRA.

- A Self-Directed IRA is a tax advantageous way to diversify your retirement account.

Self-Directed IRA Investments

Many investors open a Self-Directed IRA to diversify their retirement funds.

If you’re an IRA investor who only invests in traditional assets (stocks, bonds, mutual funds, ETFs, etc.), you can expand your investment horizons into nontraditional assets with a Self-Directed IRA. These include:

- Real Estate

- Private Funds

- Cryptocurrency

- Tax Liens

- Private Businesses

- Precious Metals

- Much more!

Types of Self-Directed IRAs

In order to expand your investment opportunities, you must establish a Self-Directed IRA. There are two types of Self-Directed IRAs.

- Custodian-Controlled IRA- A traditional Self-Directed IRA

- Checkbook Control IRA – Self-Directed IRA LLC

What’s the difference between the two? A custodian-controlled IRA is offered by some large financial institutions. However, they often restrict the types of investments you can make and you will need custodian consent on all investment decisions.

Whereas a checkbook control IRA is the true form of self-directing your retirement account. With checkbook control, there’s no need for custodian consent. You’re in charge of what investments you wish to make – when you want to buy and when you want to sell. It’s the ultimate retirement vehicle for IRA investors who want control and the opportunity to invest in alternative assets.

Self-Directed IRA Advantages

Invest in What You Understand

Americans became frustrated with the equity markets after the 2008 financial crisis. Thankfully, we have seen the financial markets rebound since then. Yet, many investors are still shell-shocked from the market swings. They are not 100% sure what goes on with Wall Street and how it all works.

Real estate, for comparison, is often a more comfortable investment for the lower and middle classes because they grew up exposed to it. Whereas the upper class is more familiar with Wall Street and other securities.

We always hear people talk about the importance of owning a home and the amount of money one can make by owning real estate. From Donald Trump to reality TV, real estate is fast becoming mainstream and a trusted asset class for Americans.

Of course, it’s not without risk, but many investors feel more comfortable buying and selling real estate than they do stocks. With a Self-Directed IRA LLC, you can make real estate and other alternative asset investments tax-deferred or tax-free with the Roth IRA. Inflation Protection

Diversification

Most Americans have an enormous amount of financial exposure to the financial markets. Whether it is through retirement investments, such as IRAs or 401(k) plans, or personal savings, many of us have most of our savings connected to the stock market.

In fact, over 90% of retirement assets are invested in the financial markets. Investing in non-traditional assets, such as real estate, offers a form of investment diversification from the equity markets. With a more diversified Self-Directed IRA, it is less likely that your assets will move in the same direction. However, diversification does not assure profit or protect against loss. Nevertheless, the use of non-traditional asset classes can help protect your portfolio when the market is down and prevent you from losing more than the market. Invest in What You Understand.

Learn more about Self-Directed IRA Myths.

Inflation Protection

Rising food and energy prices, along with high federal debt levels and low interest rates have recently fueled new inflationary fears. As a result, some investors may look for ways to protect their portfolios from the ravages of inflation.

It is a matter of guesswork to estimate whether these inflation risks are real. For some retirement investors, protecting retirement assets from inflation is a big concern. Inflation can have a nasty impact on a retirement portfolio because it means a dollar today may not be worth a dollar tomorrow.

Inflation also increases the cost of things that are necessary for humans to live and enjoy life. Some examples are gas, shelter, clothing, and medical services. It decreases the value of money so that goods and services cost more.

For example, if someone has an IRA worth $250,000 at a time of high inflation, that $250,000 will be worth significantly less or have significantly less buying power. This can mean the difference between retiring and working the rest of your life.

Many investors have long recognized that investing in commercial real estate can provide a natural protection against inflation. This is because rents tend to increase when prices do, acting as a hedge against inflation.

Related: Do Self-Directed IRAs Have Income Limits?

Hard Assets

Many non-traditional assets, such as real estate and precious metals are tangible hard assets that you can see and touch. With real estate, for example, you can drive by with your family, point out the window, and say “I own that”.

For some, that’s important psychologically, especially in times of financial instability, inflation, or political or global upheaval.

If you are looking to use your retirement funds to make alternative asset investments and expect to have a high level of transaction frequency (i.e. rental properties), are concerned about liability (real estate), wish to have greater control over your IRA, or are concerned about privacy, then the self-directed IRA LLC is the smart choice.

Learn More: Alternative Investments in an IRA

Tax Deferral

Tax deferral literally means that you put off paying taxes. The most common types of tax-deferred investments include those in IRAs or Qualified Retirement Plans. Tax-deferral means that all income, gains, and earnings accumulate tax-free until the investor or IRA owner withdraws the funds and takes possession of them.

As long as the funds remain in the retirement account, the funds will grow tax-free. This allows your retirement funds to grow at a faster pace than if the funds were held personally. As a result, you can build for your retirement faster.

When you do withdraw your IRA funds in the form of a distribution after you retire, you will likely be in a lower tax bracket and be able to keep more of what you accumulated.

So, by using a traditional IRA retirement savings vehicle:

- You don’t pay taxes on the money you invested

- You may pay taxes at a lower rate when you finally do “take home” your money

If the funds remain in the account, they grow without taxes eroding their value. This enables assets to accumulate at a faster pace, giving you an edge when saving for the long term.

Self-Directed IRA LLC

A Self-Directed IRA LLC (SDIRA) is a type of individual retirement account that allows retirement investors to use their IRA funds to make alternative asset investments. Self-Directed IRAs are similar to traditional IRAs, but they provide more investment options to IRA holders. By using this retirement structure, you can diversify your investment opportunities and invest outside of stocks, bonds, mutual funds, and other traditional assets. You can still make traditional asset investments, but if you’re more comfortable investing in assets like real estate and precious metals, the Self-Directed IRA LLC allows you to do so. Ultimately, this diversifies the assets inside of your retirement account.

This self-directed plan gives you more control over your retirement funds. However, it’s important to note that not all Self-Directed IRAs are the same. As a result, you will not find this term anywhere in the Internal Revenue Code.

With a Self-Directed IRA LLC, there are two investments you cannot make: life insurance and collectibles. Furthermore, you cannot make transactions under Internal Revenue Code (IRC) Section 4975(c). These are prohibited transactions that are broken down into categories: direct prohibited transactions and indirect prohibited transactions. Other than these three restrictions, you can make any type of investment with the Self-Directed IRA LLC.

The plan works for all types of individual retirement accounts:

- Traditional (pretax) IRA

- Roth IRA

- SEP IRA

- SIMPLE IRA

In other words, you can self-direct any of these IRAs to make alternative asset investments.

Establish the Self-Directed IRA LLC with IRA Financial by downloading our new app. With the app, you can also perform basic account maintenance.

Advantages of a Self-Directed IRA with Checkbook Control

Discover the advantages of establishing a Self-Directed IRA LLC with checkbook control.

- Invest in what you know and understand tax-free, such as real estate, tax liens, hard money loans, private businesses, cryptocurrencies, and much more

- Take control of your IRA assets and make investments from a local bank account

- Making an investment is as easy as writing a check or executing a wire transfer

- Save on custodian fees – no transaction or annual account balance fees

- Invest with limited liability protection

- Gain asset & creditor protection

- IRA Financial charges a low flat fee annually. Unlike other companies, IRA Financial does not charge account valuation fees. Furthermore, when you make an investment with your new Checkbook IRA LLC with IRA Financial, your investments are FDIC-insured.

Conclusion

A Self-Directed IRA provides multiple benefits including:

-

Establish a Self-Directed IRA

Make an IRA contribution of up to $7,000 or $8,000 if over 50 or do a tax-free rollover of IRA or 401(k) funds to fund your new account.

-

Invest in What You Know

Invest in assets you know and trust. Gain investment diversification and take control of your retirement

-

Tax-Free Gains

Generate tax-free income or gains from your Self-Directed IRA

To learn more, please contact a Self-Directed IRA specialist at 800-472-0646.