The Real Estate IRA Secret

Alternative investments such as real estate have always been permitted in IRAs; it even says so right on the IRS website. But few people seemed

Alternative investments such as real estate have always been permitted in IRAs; it even says so right on the IRS website. But few people seemed

The Solo 401(k) for real estate is highly advantageous for investors who utilizeextra capital in the form of a nonrecourse loan. Learn why at IRA Financial.

Using a Roth IRA to buy real estate is the ultimate tax solution for real estate investors. The reason is that with a Roth IRA,

Investing in real estate with a Self-Directed IRA has never been easier. Learn how to hold real estate titles in your Self-Directed IRA

Holding an Airbnb in your IRA makes for an interesting investment choice as it provides a nice stream of income, however, beware of the UBTI rules.

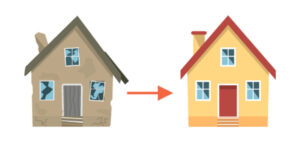

Flipping homes in a Self-Directed IRA has quickly become one of the most popular investment concepts. The primary advantage of signing a retirement account, such

When using leverage with retirement funds to make an investment, you must use a non-recourse loan. Understand the pros and cons of doing so.

It’s easy to flip homes or engage in a real estate transaction with a Solo 401(k) plan. It’s as easy as writing a check from

Since the creation of the Solo 401(k) Plan back in the early 1980s, the IRS (Internal Revenue Service) has always permitted a Solo 401(k) to

Key Points Real estate investing is the most popular one for Self-Directed IRAs Knowing how much you need makes for easier decisions IRA Financial will

Subscribe to stay updated on everything self-directed retirement, and learn how your investments are affected by current events and changes in the law.

Contact IRA Financial at 1-800-472-0646 or fill out the form to learn more about opening a self-directed retirement account.

Click here to schedule a call instead.

We don’t share your personal information with anyone. Check out our Privacy Policy for more information.

[email protected]

1-800-472-0646

IRA Financial Group

1691 Michigan Avenue, #335

Miami Beach, FL 33139