Alternative investments such as real estate have always been permitted in IRAs; it even says so right on the IRS website. But few people seemed to know about this option until the last several years.

A Self-Directed IRA is essentially an IRA that allows for alternative asset investments, such as real estate or even cryptocurrency. Traditional financial institutions do not allow IRAs to invest in IRS-approved alternative assets, such as real estate, because their focus is on earning fees through traditional investments. When it comes to making investments with a Self-Directed IRA, the IRS generally does not tell you what you can invest in, only what you cannot invest in. The types of investments that are not permitted to be made using retirement funds are outlined in Internal Revenue Code Sections 408 and 4975. These rules are generally known as the “Prohibited Transaction” rules. Other than life insurance, collectibles, and transactions that involve or directly or indirectly benefit the IRA holder or a “disqualified person,” one can use their IRA to make the investments. A “disqualified person” is generally defined as the IRA holder and any of his or her lineal descendants and/or any entities controlled by such persons. Thus, so long as the real estate investment does not directly or indirectly benefit a “disqualified person,” it is a permissible self-directed IRA investment.

What Type of IRA Can be Used to Buy Real Estate?

All IRAs can be used to buy real estate with a self-directed IRA, including a traditional IRA, Roth IRA, SEP IRA, and SIMPLE IRA. In addition, even an HSA and Coverdell can invest in real estate and generate tax-deferred income and gains.

What are the Advantages of Buying Real Estate in an IRA?

The Self-Directed IRA is the most popular Self-Directed retirement solution. A Self-Directed IRA is the perfect retirement or investment vehicle for anyone looking to use their IRA or 401(k) to invest in non-publicly traded securities. The primary advantages of using a Self-Directed IRA are you gain the ability to invest in almost anything you want, diversify your retirement assets, hedge against inflation, plus generate income and gains tax-free.

Below are the primary advantages of investing in real estate with an IRA.

Diversification: Whether it is through retirement investments, such as IRAs 401(k) plans, or personal savings, many of us have most of our savings connected in some way to Wall Street. Over 90% of retirement assets are invested in the financial markets. Investing in alternative assets, such as real estate offers a form of investment diversification from the equity markets. In general, the more diversified your portfolio, the greater the chance that your assets will offer lower correlation, meaning they are less likely to move in the same direction.

Invest in Something You Understand: Many Americans became frustrated with the volatility of owning stocks. Many Americans are somewhat shell-shocked from the market swings and not 100% sure what exactly goes on on Wall Street and how it all works. Real estate, for comparison, is easier to understand. Real estate is quickly becoming a mainstream asset category and one of the most trusted asset classes for Americans. Many retirement investors feel more comfortable understanding the real estate market and buying and selling real estate than they do stocks. Many investors feel comfortable with the ability to use their retirement funds to invest in an investment they can understand, such as real estate which provides the potential for asset appreciation and income stream.

Hard Asset & Inflation Protection: Many alternative assets, such as real estate, are tangible hard assets that you can see and touch. With real estate, for example, you can drive by with your family, point out the window, and say, “My IRAs owns that”. For some, that’s important psychologically, especially in times of financial instability, inflation, or political or global upheaval.

Tax-Deferred or Tax-Free Cash Flow. Using a self-directed IRA to invest in real estate allows the retirement account holder to generate tax-deferred or tax-free income or gains, in the case of a Roth IRA or Roth 401(k). In general, all income from the sale of real estate or from rental income would flow back to the retirement account without tax.

How to Buy Real Estate in an IRA

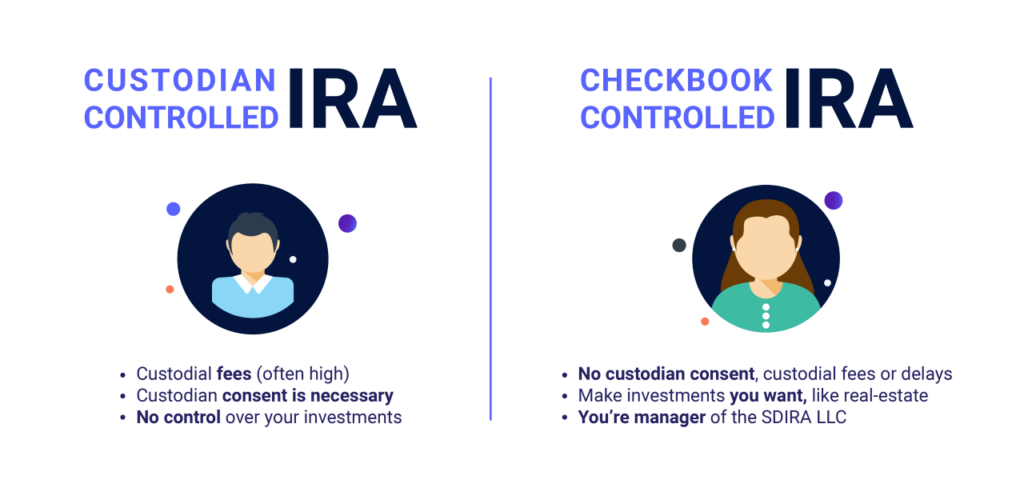

Generally, there are two ways to invest in real estate investments with a Self-Directed IRA, (i) the full-service Self-Directed IRA, and (ii) the Self-Directed IRA LLC with “checkbook control.”

Full-Service Self-Directed IRA

A full-service Self-Directed IRA offers an IRA investor more investment options than a financial institution Self-Directed IRA. With a full-service Self-Directed IRA, a special IRA custodian will serve as the custodian of the IRA. Unlike a typical financial institution, a Self-Directed IRA custodian generates fees simply by opening and maintaining IRA accounts and does not offer any financial investment products or platforms. With a full-service Self-Directed IRA, the IRA funds are generally held with the IRA custodian, and at the IRA holder’s sole direction, the IRA custodian will then invest the IRA funds into alternative asset investments, such as real estate. Investments are made in the name of the Self-Directed IRA and all investment income and gains from the Self-Directed IRA would flow tax-free to the IRA.

Self-Directed IRA LLC

The Self-Directed IRA LLC with “checkbook control” has quickly become the most popular vehicle for investors looking to make alternative assets investments, such as rental real estate that require a high frequency of transactions. Under the checkbook IRA format, a limited liability company (“LLC”) is created which is funded and owned by the IRA and managed by the IRA holder. The “checkbook control” Self-Directed IRA allows one to eliminate certain costs and delays often associated with using a full-service IRA custodian. The Checkbook IRA LLC structure allows the investor to act quickly when the right investment opportunity presents itself cost-effectively and without delay. The IRA investment will be titled in the name of the LLC and not the IRA, providing the IRA owner with a greater degree of privacy, on top of the advantage of limited liability protection and greater control.

Why Use IRA Financial

IRA Financial “literally” wrote the book on the Self-Directed IRA. Our founder, Adam Bergman, Esq, has written 8 books on Self-Directed retirement plans and over the last 15+ years has helped over 24,000 Self-Directed clients invest over $3.2 billion in alternative assets.

IRA Financial Self-Directed IRA is specifically designed and customized for each type of investment. Whether it is real estate, private equity, venture capital, hedge fund, private business, cryptos, precious metals, hard money loans, and much more, our Self-Directed tax experts will work with you to design the perfect Self-Directed IRA solution for your investment. Additionally, IRA Financial is the only Self-Directed retirement company that provides annual consulting, IRS tax reporting/filings, BOI FinCEN reporting, and full IRS audit guarantee.

See for yourself why IRA Financial is one of the leading providers of Self-Directed IRAs in the country:

- Customized Self-Directed IRA design for your investment

- Flat annual fees

- No transaction or asset value fees

- No wire of check fees

- IRA & 401(k) personalized rollover support

- IRS tax reporting, including IRS Form 5498 & 1099-R

- BOI Reporting with FinCEN

- LLC IRS tax filing (Form 1065) and UBIT tax filings (Form 990-T)

- Free Self-Directed Roth IRA conversion

- Free RMD support

- Free tax research on Self-Directed IRA topics

One-on-one tax support on the “disqualified person” and “prohibited transaction rules.”

- One-on-one tax consultation on UBTI and UDFI rules

- Free access to our best-selling Self-Directed IRA books

- Free access to our educational webinars, podcasts, and newsletters

- Self-Directed IRA IRS audit guaranty

- Free HSA & Coverdell account for year 1 (value of $920)