Flipping homes in a Self-Directed IRA has quickly become one of the most popular investment concepts. The primary advantage of signing a retirement account, such as an IRA or 401(k), to buy and sell real estate is that all the income and gains from the real estate flipping transaction will go back to the IRA tax-free.

This article will use a case study to explore how one can use their retirement funds to generate tax-free gains from a real estate flipping transaction.

Facts

Jen is 47 years old and has been looking to get involved in the passive real estate investing space. Jen has an IRA of $175,000 at a traditional financial institution. Jen is also in the process of leaving her current employer for a new job. She has $125,000 in her former employer’s 401(k) plan. Jen lives in the Dallas area and has been noticing several homes for sale in her neighborhood. After generating some solid returns in the stock market over the last several years, Jen is looking to gain some added diversification by gaining more exposure to real estate.

After spending some time online, Jen found a home in her neighborhood that she thought was priced right. Jen believed that if she put some money into landscaping and did some other internal improvements, she could flip the home at a higher price. Jen had some personal savings, but most of her savings were tied up in her retirement account. After doing some online searches Jen quickly discovered that she could set up a Self-Directed IRA and use her retirement funds to purchase the home tax-free. Best of all, the gains from the real estate flip would go back to the Self-Directed IRA without tax.

What is a Self-Directed IRA?

A Self-Directed IRA is essentially an IRA that allows for alternative asset investments, such as real estate or even cryptocurrency. Traditional financial institutions do not allow IRAs to invest in IRS approved alternative assets, such as real estate, because their focus is on earning fees through traditional investments.

When it comes to making investments with a Self-Directed IRA, the IRS generally does not tell you what you can invest in, only what you cannot invest in. The types of investments that are not permitted to be made using retirement funds is outlined in Internal Revenue Code Section 408 and 4975. These rules are generally known as the “Prohibited Transaction” rules. Other than life insurance, collectibles, and transactions that involve or directly or indirectly benefit the IRA holder or a “disqualified person,” one can use their IRA to make the investments. A “disqualified person” is generally defined as the IRA holder and any of his or her lineal descendants and/or any entities controlled by such persons.

Hence, so long as the real estate investment does not directly or indirectly benefit a “disqualified person,” it is a permissible Self-Directed IRA investment.

The IRS has always permitted real estate to be held inside IRA retirement accounts. Investments with a Real Estate IRA are fully permissible under the Employee Retirement Income Security Act of 1974 (ERISA). Real estate is one of the most popular Self-Directed IRA investments. IRS rules permit you to engage in almost any type of real estate investment, aside generally from any investment involving a disqualified person.”

Why Should Jen Flip Real Estate Using a Self-Directed IRA?

The concept of tax deferral stems from the notion that all income and gains the pretax retirement account generates will flow back into the account tax-free. Instead of paying tax on the returns of a Self-Directed IRA investment, such as real estate, you pay tax at a later date, so your investments grow unhindered.

For example. Jen is 22 years old. Assuming Jen makes an annual Self-Directed IRA contribution of just $365 a year from age 22 through age 70. Assuming Jen gets an annual rate of return of 8% on her IRA investments. Also, assume Jen would have a 25% income tax rate. Based on these numbers, Jen would have $ 193,210 in her Self-Directed IRA at age 70, but only $99,265 if she invested using a taxable account.

Where Can I Open a Self-Directed IRA?

IRAs were created in 1974 by ERISA. When IRAs were created, ERISA did not distinguish between an IRA that invested in traditional or alternative assets, such as real estate. When it comes to making investments with a Self-Directed IRA, the IRS generally does not tell you what you can invest in, only what you cannot invest in. The types of investments that are not permitted to be made using retirement funds is outlined in Internal Revenue Code Sections 408 and 4975. These rules are generally known as the “Prohibited Transaction” rules. Other than life insurance, collectibles, and transactions that involve or directly or indirectly benefit the IRA holder or a “disqualified person,” one can use their IRA to make the investments. A “disqualified person” is generally defined as the IRA holder and any of his or her lineal descendants and/or any entities controlled by such persons. Note – siblings are not considered “disqualified persons.”

Traditional financial institutions do not allow IRAs to invest in IRS-approved alternative assets, such as real estate, because their focus is on earning fees through traditional investments. Hence, the birth of the Self-Directed IRA industry. Today, the Retirement Industry Trust Association (RITA) estimates anywhere between 4-7% of all IRAs are invested in alternative assets. Accordingly, the Self-Directed IRA is the only way one can purchase alternative assets in an IRA.

Rollover Rules & The Self-Directed IRA

There are two general ways to fund an IRA: (i) IRA contribution and (ii) IRA transfer/rollover.

IRA Contribution

The first is making an IRA contribution. In 2024, one can contribute up to $7,000 or $8,000 if over the age of 50 to an IRA or Roth IRA, subject to certain income limitations. IRA contributions for 2023 can be made up to April 15, 2024. In order to make an IRA contribution, one must have earned income. Passive income, such as capital gains, does not count as earned income.

IRA Transfer/Contribution

To permit tax-free transfers of retirement savings from one type of investment to another, as well as to increase the portability of qualified plan rights for employees moving from one job to another, Congress permitted the transfer of IRA funds between IRAs and the rollover of 401(k) funds to IRA under certain circumstances. In general, a rollover of retirement funds to an IRA is tax-free. Rollovers can either be direct or indirect. A direct rollover can be done without limit, whereas an indirect rollover can only be done once every 12 months.

IRA Transfer

A rollover from one traditional IRA to another Traditional IRA is called a transfer and can be done without limit. A transfer occurs between IRAs and a rollover occurs when one of the retirement accents involved is not an IRA. For example, moving funds from a 401(k) plan to an IRA is treated as a direct rollover, whereas, moving funds between IRAs is called a transfer. A transfer of IRA funds can be done in cash or in-kind.

401(k) Rollover

In general, to move funds from a 401(k) to an IRA, one would need a plan “triggering event.” Generally, a plan “triggering event” consists of one of the following: (i) you are over the age of 591/2, (ii) you leave your job, or (iii) the company terminates the plan. If funds are rolled directly from a 401(Ik) plan to an IRA there is no tax or penalty. Whereas, an indirect rollover (the funds are sent to the individual plan participant directly and not the IRA custodian) of funds from a 401(k) plan to an IRA could be subject to a 20% withholding tax.

Hence, in Jen’s case, Jen would be able to fund a Self-Directed IRA using the $175,000 from her existing IRA and $125,000 from her former employer’s 401(k) plan. Note – since Jen is under the age of 59 1/2 if Jen did not leave her job, she would not have a plan “triggering event” and would not have access to her 401(k) funds to use as a rollover to an IRA. In such a case, Jen could use a 401(k)-loan option, if one existed in the plan, to borrow the lesser of $50,000 of 50% of her account value to use for her real estate deal tax-free. However, Jen would be required to pay back the loan over 5 years using the Prime interest rate.

How to Buy Real Estate in a Self-Directed IRA

On top of having the advantage of sheltering Self-Directed IRA income and gains to tax, establishing a Self-Directed IRA is also a great way to better diversify your retirement savings, gain the ability to hedge against inflation, invest in assets you know and trust, as well as gain exposure to potentially lucrative investments, such as real estate, investment funds, as well as cryptos.

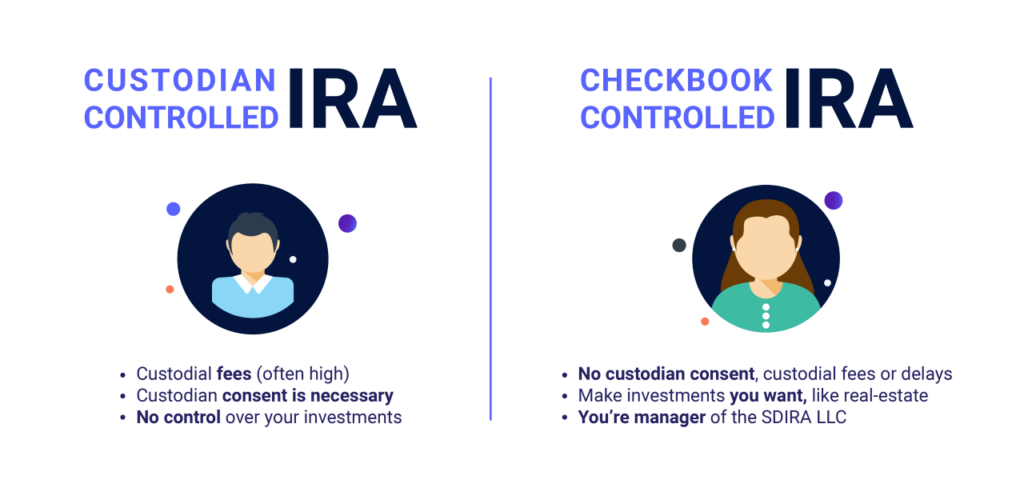

The following are the two most common Self-Directed IRA structures.

On top of having the advantage of sheltering Self-Directed IRA income and gains to tax, establishing a Self-Directed IRA is also a great way to better diversify your retirement savings, gain the ability to hedge against inflation, invest in assets you know and trust, as well as gain exposure to potentially lucrative investments, such as real estate, investment funds, as well as cryptos.

- Self-Directed IRA – Full-Service

- Self-Directed IRA – “Checkbook Control”

With a Self-Directed IRA with checkbook control, an IRA is set-up with a Self-Directed IRA custodian, such as IRA Financial. The IRA is then invested into a special purpose limited liability company (“LLC”), which IRA Financial can help you establish. The Self-Directed IRA LLC is then managed by the IRA owner providing the IRA owner with “checkbook control” over the IRA funds. With a “checkbook control” Self-Directed IRA LLC, the manager of the Self-Directed IRA LLC will have the authority to make investment decisions without the involvement of the custodian. Plus, a Self-Directed IRA LLC will offer the IRA owner with limited liability protection over IRA investments. Moreover, all Self-Directed IRA investments will be titled in the name of the LLC offering the IRA owner more privacy. without needing the consent of an IRA custodian. With a Self-Directed IRA LLC with “Checkbook Control’ you will be able to buy real estate by simply writing a check.

All types of IRAs can be transferred tax-free to a Self-Directed IRA LLC. A Self-Directed IRA with “checkbook control” is popular with IRA investors seeking to invest in alternative assets, such as rental properties, fixes and flips, tax liens, or cryptocurrencies that require a high frequency of transactions.

Thus, Jen would have the option of using a Self-Directed IRA or a Self-Directed IRA LLC with “checkbook control” to do her real estate deal. For real estate investors who will be engaged in a higher frequency of activity, such as a flipper, who will need to engage and pay multiple third parties as part of the real estate improvement process, the use of the “checkbook control” LLC is a far more popular choice. In addition to gaining more control over the real estate rehab process, Jen would also get limited liability protection and a greater degree of privacy. Whereas, if Jen was buying a piece of land to hold or investing in a real estate passive fund, the use of the IRA LLC would be far less important.

Tips for Buying Real Estate in a Self-Directed IRA

Real estate is the most popular investment class for Self-Directed IRA investors. The reason for this is that real estate is a tangible asset that is easy to understand. Real estate is also proven to be a great way to hedge against inflation as well as a key investment diversification tool.

Buying real estate with a Self-Directed IRA is quite simple and easy. Below is the steps Jen took to buy and sell real estate in her Self-Directed IRA. Continue reading and you will see how Jen’s real estate investment turned out.

- Locate the real estate property and perform diligence.

- Make an offer to purchase the real estate property. Jen made the offer in her name with the right to assign to her Self-Directed IRA.

- Jen establishes a Self-Directed IRA with IRA Financial

- IRA Financial initiates the tax-free IRA transfer for Jen

- Jen initiates the former employer 401(k) plan rollover to her new Self-Directed IRA The IRA custodian can initiate IRA transfers but only the former employee can initiate rollovers from a 401(k) plan to an IRA.

- Jen is notified by IRA Financial when the IRA and former employer 401(k) funds arrive at IRA Financial

- Since Jen elected to use a Self-Directed IRA LLC with “checkbook control,” Jen provides IRA Financial with the LLC details, such as proposed name and address in the state. Since the real estate would be located in Texas, IRA Financial recommends that Jen establish the LLC in Texas.

- Jen notifies her real estate agent that she wishes to purchase the real estate in the name of an LLC.

- IRA Financial establishes the Texas LLC for Jen, which she calls Applesouth Investments LLC. Jen could select any LLC name of her choice so long as the name was available with the state. Jen elects to be the manager of the LLC giving her “checkbook control.” IRA Financial also acquires a Tax ID# for the LLC and prepares a LLC operating agreement for the new IRA LLC.

- Jen elects to open a bank account at Capital One, a banking partner of IRA Financial. Jen is free to open the LLC bank account at any local bank of her choice, but she likes the fact that IRA Financial could establish her LLC bank account in minutes without her having to step foot in a bank.

- At Jen’s direction, IRA Financial sends the $300,000 of IRA funds into the new LLC bank account at Capital One.

- Jen provides all the LLC related info to her real estate agent for closing.

- At closing, Jen signs the real estate purchase documents as manager of the LLC. Title to the real estate is in the name of Applesoutrh Investments LLC

- Jen purchases the home for $242,000.

- After closing, Jen starts using her IRA funds from the Applesouth Investments LLC bank account to pay the contractor and other service providers. In all Jen, spends $35,000 on improvements to the home.

- 6 months later Jen puts the home up for sale for $385,000 and sells it for $380,000.

- In 6 months, using her Self-Directed IRA, Jen made $103,000 tax-free. Jen sold the property for $380,000 and she was able to buy the property for $242,000 and sent $35,000 on improvements.

- If Jen used personal funds, she would have had to pay ordinary income tax on the $103,000 of gain since she held the property less than 12 months.

- Jen is now looking for her next real estate project and has $103,000 more funds to spend in order to generate an even bigger tax-free gain.

Tips For Using a Self-Directed IRA to Flip Real Estate

- The deposit and purchase price for the real estate property should be paid using IRA funds or funds from a non-disqualified third party.

- No personal funds or funds from a “disqualified person” should be used.

- All expenses, repairs, and taxes incurred in connection with the Self-Directed IRA Plan real estate investment should be paid using retirement funds – no personal funds should be used.

- If additional funds are required for improvements or other matters involving the real estate investments, all funds should come from the Self-Directed IRA or a non “disqualified person.”

- If financing is needed for a real estate transaction, only non-recourse financing should be used. A non-recourse loan is a loan that is not personally guaranteed and whereby the lender’s only recourse is against the property and not against the borrower.

- No services should be performed by the IRA owner or “disqualified person” in connection with the real estate investment. In general, other than typical trustee type of services (necessary and required tasks in connection with the maintenance of the plan), no active services should be performed by the IRA owner or a “disqualified person” with respect to the real estate transaction.

- Title of the real estate purchased should be in the name of the IRA custodian for the benefit of the IRA owner. For example, IRA Financial Trust Company FBO John Doe IRA. However, in the case of a Self-Directed IRA LLC, the title to the real estate would be in the name of the LLC.

- Keep good records of income and expenses generated by the real estate investment.

- All income, gains, or losses from a Self-Directed IRA real estate investment should be allocated back to the IRA.

- Make sure you perform adequate diligence on the property you will be purchasing especially if it is in a state, you do not live in

- Make sure you will not be engaging in any self-dealing real estate transaction that would involve buying or selling real estate that will personally benefit you or a “disqualified person.”

Conclusion

Using a Self-Directed IRA to flip real estate is one of the best legal hidden tax-shelters. Most real estate investors are aware of the 1031 exchange solution. However, the Self-Directed IRA essentially provides a real estate investor with the same tax-free advantages. The case of Jen highlighted the major tax advantages one can enjoy using a Self-Directed IRA to flip real estate, along with investment diversification and the ability to invest in a hard asset you can trust. Today, establishing a Self-Directed IRA is easier and more cost-effective than ever before. The whole process will take just a few days and the set-up and ongoing fees can be paid using either IRA or personal funds. Best of all, companies such as IRA Financial charge annual low flat fees so as your IRA assets grow in value, you will still pay the same low annual fee. What are you waiting for? Join Jen and the millions of other Self-Directed IRA investors who have gained the freedom to take control of their retirement funds to invest in almost anything they want tax-free.