Self-Directed IRA

Take control of your retirement by investing in alternative assets, like real estate and gold.

What is a Self-Directed IRA?

A Self-Directed IRA is a type of individual retirement account that allows for more freedom than you will receive at a local bank or other financial institution. A Self-Directed IRA custodian, such as IRA Financial, simply administers the plan and does not offer investment products or advice. Because of this, you are free to invest in anything you want, so long as it is not prohibited by the IRS.

The main advantage of the Self-Directed IRA is the ability to invest in alternative assets, including real estate, precious metals, private business, cryptocurrency, and so much more. This allows you to properly diversify your IRA portfolio and gives you the freedom to invest in hard assets you know and trust. Of course, a Self-Directed IRA has all the popular benefits of a regular IRA including tax deferral, Roth options, and the ability to invest in traditional assets, such as stocks, mutual funds, and ETFs.

Types of Self-Directed IRAs

Custodian Controlled

Self-Directed IRA

Self-Directed IRA

- IRA Financial Makes Investments at Your Request

- Save Money on Set-Up Costs

- Title to the Assets will be in the name of the custodian, care of the IRA Owner

- No Need for an LLC

- Best for those with a Low Frequency of Transactions

Self-Directed IRA LLC with Checkbook Control

- You are in Total Control of Your Investments

- Gain Checkbook Control of Your IRA Funds

- Title to the Assets will be in the Name of the IRA LLC

- Limited Liability Protection

- Best for those with a High Frequency of Transactions

The IRA Financial Difference

24,000+ clients

Our tax and ERISA experts have helped over 24,000 clients in all 50 states.

No hidden fees

No transaction or asset value fees. No minimum balance requirement (with credit card on file).

Serve as your custodian

Holds over $3.2 Billion in alternative assets.

Expertise

IRA Financial’s founder, Adam Bergman, is the author of nine books on self-directed retirement.

Dedicated support

Get direct access to a self-directed retirement expert to establish your plan.

Technology

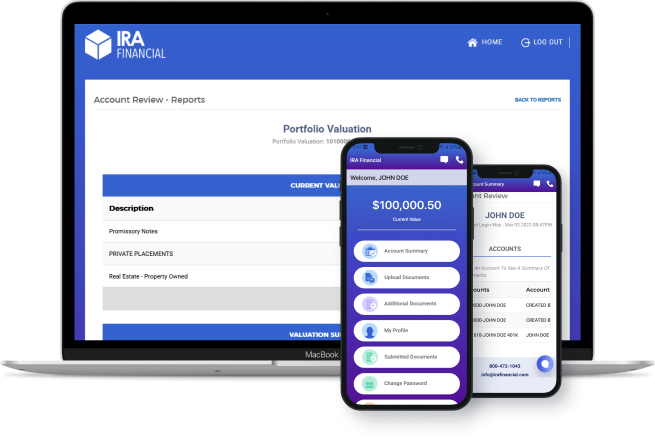

Use our app to set up and maintain your account.

Open a Self-Directed IRA

Complete your application

Once completed, it will go into a queue to be reviewed (generally, 3-5 days).

Application is reviewed

Your application is reviewed to ensure everything is filled out correctly

Account number assigned

Once your application is approved, an account number is assigned and emailed to you (an additional 3-5 days).

Fund your account

You can now fund your Self-Directed IRA via transfer, rollover, or direct contribution.

Start investing

Once your IRA is funded, you can begin making investments!

Endless investments opportunities.

Real Estate

Whether it’s residential or commercial, rental properties or raw land, real estate is the #1 alternative investment among retirement investors.Precious Metals

Metals Metals and coins have long been used as a hedge against a volatile economy – just make sure they are IRS-approved precious metals and not held personally.Private Placements

Placements Investment opportunities offered to a select group of high net worth or institutional investors that have reduced risk and assured returns.

Tax Liens/Deeds

Tax liens and deeds allow for exposure to the real estate market in your portfolio without having to invest in the properties themselves.Investment Funds

Hedge funds and private equity fund investments are generally for more sophisticated, accredited investors.

Quick FAQ & Further Reading

A regular IRA, oftentimes referred to as a traditional IRA, is generally overseen by a broker or investment advisor. The IRA funds are restricted to traditional investments, such as stocks, bonds and mutual funds. While Self-Directed IRAs also allow you to purchase stocks, you can also invest in hard assets, such as real estate, cryptocurrencies, gold and other precious metals, hard-money loans, and more!

Of course, “traditional” simply means it was the original IRA (as opposed to the Roth, which came along after). Basically, it refers to a pretax IRA. All contributions are made with pretax funds and no taxes are due until you withdraw from the plan. This is known as tax deferral.

All pretax IRAs, whether they are self-directed or not, are considered traditional plans. For the purposes of this article, we are using the terms regular and traditional interchangeably, since many people often confuse the two! Everything boils down to where you open your plan and how much freedom they offer you

You can make virtually any type of investment with a Self-Directed IRA. There are very few investments you cannot make with your IRA funds. The IRS says you cannot invest in life insurance or collectibles, such as art and rugs. Essentially, everything else is permitted so long as you don’t break the prohibited transaction rules. Your Self-Directed IRA investment can only benefit the plan itself, and not you (or any disqualified person) personally.

Popular investments in a Self-Directed IRA include:

- Residential or commercial real estate

- Domestic or Foreign real estate

- Raw land

- Foreclosure property

- Mortgages

- Mortgage pools

- Deeds/Notes

- I Bonds

- Hard money lending

- Private loans

- Tax liens

- Private businesses

- Limited Liability Companies

- Limited Liability Partnerships

- Private placements

- Stocks, bonds, mutual funds

- Foreign currencies

- Gold

- Silver

- Precious Metals & Coins

- Bitcoin

- Litecoin

- Dogecoin

- Other Cryptocurrencies

- Hedge Funds

- Private Equity Funds

A Self-Directed IRA LLC offers you the ability to use your retirement funds for almost any type of investment without custodian consent. The IRS only describes prohibited investments, which are life insurance and collectibles.

The majority of Americans wealth is invested in traditional equities and fixed income markets. There are approximately 60 million IRAs worth approximately $12 trillion dollars. It is estimated that close to 94% of IRA assets are invested in traditional investments, like stock. Since the creation of IRAs in 1974, alternative investments such as real estate have always been permitted to be invested by IRAs. But few people seemed to know about this option until the last several years. So why can’t you invest your IRA in alternative assets at a bank or traditional brokerage firm?

Not surprisingly, the answer comes down to money. Traditional brokerage firms make money and fees on your cash and from selling traditional investments, like stocks, mutual funds, and ETFs. They do not generate any revenues or profits when your IRA invests in alternative investments, such as real estate. Hence, it is not in their financial interest to publicize the fact that the IRS allows all IRAs to invest in alternative assets, such as real estate, precious metals, cryptocurrencies, private placements and much more.

Many IRA investors believe they must invest their IRA in stocks, bonds and bank CDs. Fewer investors know that they can invest in real estate, tax-liens, precious metals, cryptocurrencies and other non-traditional assets. However, the IRS permits non-traditional assets to be held inside IRA retirement accounts. These investments with a Self-Directed IRA, or Self-Directed IRA LLC are fully permissible.

The main benefits of a self-directed IRA are:

- Investing in what you know and understand.

- All the income and gains are tax-deferred or tax-free in the case of a Roth IRA.

- Great flexibility in terms of the type of assets you can hold.

- The ability to diversify your retirement portfolio.

- The ability to invest in a real-estate IRA. Additionally, you can also use your self-directed IRA to flip houses.

IRA Financial Group is the only company where you can set up a Self-Directed IRA directly from our mobile app. That means you can do everything from our app, set up and account, fund the account, invest, and establish a Self-Directed IRA. It’s very simple to set up. All you need to do is set up an account with IRA Financial, roll over funds into your new Self-Directed IRA or make an initial contribution. After setting up your Self-Directed IRA, you will be able to invest in alternative and traditional investments such as real estate or stock directly from your account. You’re able to open the account directly from our app, never leave your house, no need to ever go to a bank.

For 2025, you can contribute up to $7,000 plus an additional $1,000 catch-up contribution if you are age 50 or older. IRA contributions can be made in pretax, after-tax and Roth.

Transfers occur between like accounts (IRA to IRA), while a rollover is from a different account (401(k) to IRA). A direct transfer or rollover goes directly from one custodian to another. An indirect transfer or rollover goes to you first. You then have 60 days to contribute the funds to a new plan.

Learn More: How the Self-Directed IRA Rollover Works

An IRA cannot engage in a transaction with a disqualified person; these include you (the IRA Owner), your spouse, any lineal descendants or ascendants (parents, grandparents, children, grandchildren), their spouses, and any entity where a disqualified person owns more than 50%

Yes! You can have as many IRAs as you wish, however, the annual IRA contribution limit applies to all plans in the aggregate.

You can withdraw traditional IRA funds at any time. However, if you are under age 59 ½, you will face a 10% early withdrawal penalty. Once you reach that age, only taxes will be due. Roth IRA contributions can be withdrawn at anytime without tax or penalty. You must wait until age 59 ½ and for your Roth to be open at least five years to withdraw gains or face taxes and penalties.

A required minimum distribution (RMD) is the amount you must withdraw from your traditional IRA once you reach age 73. The amount is generally about 3% of the total account balance.

Unlike a traditional IRA, a Roth IRA is funded with after-tax dollars. There is no upfront tax break, however, all qualified distributions are tax free!

If you wish to move traditional, pretax retirement funds into a Roth IRA, you may perform a conversion. Any amount converted to Roth will be taxable during the year of the conversion.

If your adjusted gross income exceeds the annual limit, you cannot directly contribute to a Roth IRA. However, you may contribute after-tax dollars to a traditional account, and then immediately convert them to Roth.

Learn More: Can I Still Do a Backdoor Roth IRA?