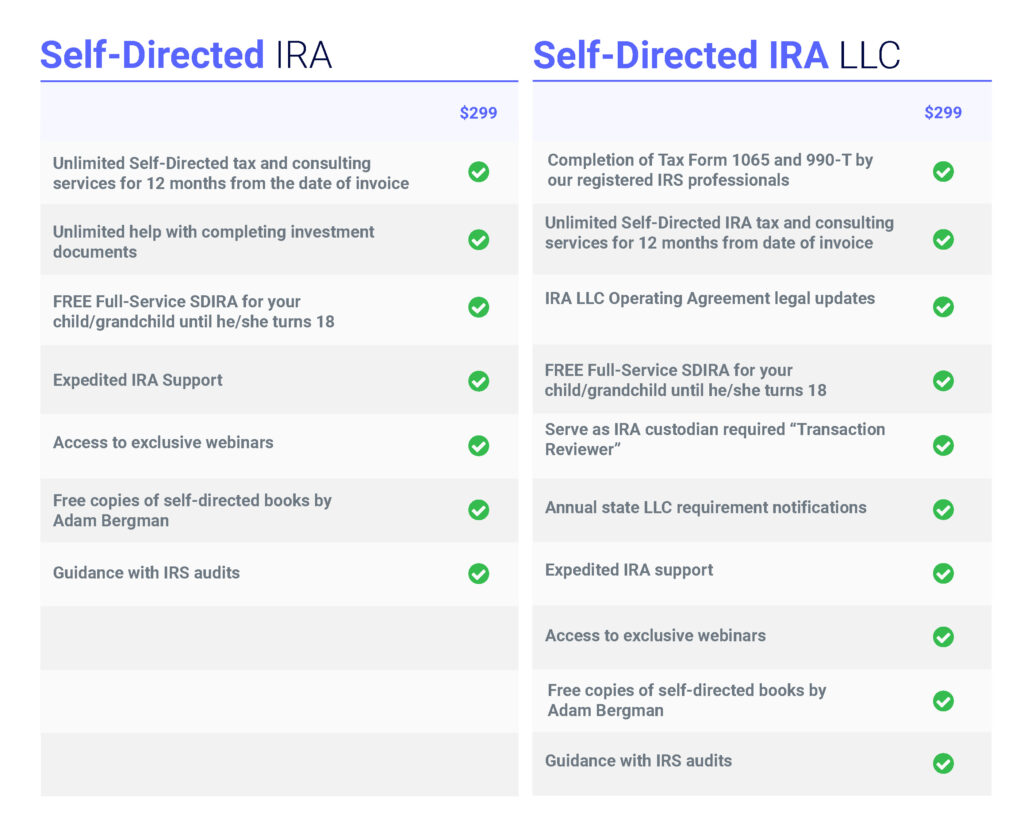

Self-Directed IRA Annual Compliance Service

IRS tax rules and guidelines change annually. IRA Financial ensures your Self-Directed IRA structure remains compliant and respected by the IRS.

Premium compliance service is FREE for the first year.

Self-Directed IRA

$

299

Annually

-

Unlimited Self-Directed IRA tax & consulting services for 12 months from date of invoice

-

Unlimited help with completing investment documents

-

Free full-service SDIRA for your child or grandchild until he/she turns 18

-

Expedited IRA support

-

Access to exclusive webinars

-

Free copies of self-directed retirement books by Adam Bergman

Self-Directed IRA LLC

$

299

Annually

-

Completion of IRS Form 1065 & 990-T by our registered IRS professionsals

-

Unlimited Self-Directed IRA tax & consulting services for 12 months from date of invoice

-

IRA LLC operating agreement legal updates

-

Free full-service SDIRA for your child or grandchild until he/she turns 18

-

Serve as IRA custodian-required "transaction reviewer"

-

Expedited IRA support

-

Access to exclusive webinars

-

Free copies of self-directed retirement books by Adam Bergman

Our annual Premium Compliance Service has been upgraded and reduced from $500 to $299. If you were a premium compliance client, your service will automatically be converted to the new pricing.