Self-Directed IRA custodian fees matter and could cost you tens of thousands of dollars for your retirement by making the wrong custodian choice for your Self-Directed IRA.

Do you really know how much Self-Directed IRA fees you are paying? If you don’t know off the top of your head, you’re not alone. There are numerous Self-Directed IRA providers, but many people still do not know the fees they pay annually to Self-Directed their retirement. Many don’t even realize that the Self-Directed IRA custodian is charging them an annual fee based on the value of their IRA. It is certain that if more Self-Directed IRA investors did not find the task of figuring it out confusing and difficult, more Self-Directed IRA investors would be turning to flat annual IRA custodian fee options. Numbers don’t lie. A customer with $200,000 that grows to $400,000 over a ten-year period would pay an extra $5000 or so of IRA fees versus choosing a flat fee option with a Self-Directed IRA custodian, such as IRA Financial. That’s close to $5000, or 1.60% of a customer’s average IRA assets of $300,000 cumulatively over the 10 years that they chose to Self-Directed. This is exactly why it is so important to understand your Self-Directed IRA custodian fees, as overpaying for Self-Directed IRA custodian fees will impact your retirement savings.

What is a Self-Directed IRA Custodian?

Pursuant to Section 408 of the Internal Revenue Code, an IRA must be established by a bank, financial institution, or authorized trust company. Thus, a bank such as Wells Fargo, financial instruction such as Vanguard, or a trust company such as the IRA Financial Trust Company are authorized to establish and administer IRAs. The main difference is that not all IRA custodians allow the IRA to invest in alternative assets, such as real estate.

The majority of all Self-Directed IRA custodians are non-bank trust companies for the reasons outlined above. The Self-Directed IRA custodian, or trust company, will typically have a banking relationship with a bank that will hold the IRA funds in a special account called an omnibus account, offering each Self-Directed IRA client FDIC protection of IRA funds up to $250,000 held in the account. For example, IRA Financial Trust is a non-banking IRA custodian. IRA Financial Trust has partnered with Capital One Bank, one of the largest banks in the country, to offer our Self-Directed IRA clients with a safe and secure way to make Self-Directed IRA investments.

What Does a Self-Directed IRA Custodian Do?

In general, a Self-Directed IRA custodian is responsible for complying with IRS rules for the administration and recordkeeping of your Self-Directed IRA. The two main functions of a Self-Directed IRA are filing IRS Form 5498 and IRS Form 1099-R. IRS Form 5498 is filed annually with the IRS and provides the IRS with an overview of the Self-Directed IRA account value and general investment history. Whereas, IRS Form 1099-R gives the IRS information as to any contributions, transfers, rollovers, or distributions involving the Self-Directed IRA

The following are the primary roles and responsibilities of a Self-Directed IRA custodian:

-

- Permitted to hold and custody IRA and 401(k) plan assets

-

- Subject to state regulation by the state division of banking

-

- Performance of administrative record-keeping regarding the Self-Directed IRA

-

- Perform administrative review of the Self-Directed IRA assets

-

- Assisting in opening & funding your IRA account

-

- Making the investment(s) on your behalf

-

- Making distributions & paying expenses per your request

-

- Providing you with quarterly statements

-

- Answering questions about your account and our procedures

-

- Reporting information required by the IRS and other governmental agencies

-

- IRS Form 1099R – Distributions from your IRA

-

- IRS Form 5498 – Contributions to, and Fair Market Value of, your IRA

A Self-Directed IRA custodian is not permitted to offer any investment advice or sell investment products. Hence, establishing a Self-Directed with a custodian who will charge your IRA fees based on the annual value of the IRA is illogical. The entire purpose behind a Self-Directed IRA is that the owner gets to “self-direct” his or her IRA investments. With a Self-Directed IRA, the IRA owner has total control and freedom to make investment decisions on behalf of the IRA. Hence, all IRA gains or losses solely reflect the investment decisions of the IRA owner. A Self-Directed IRA custodian that imposes annual asset valuation fees on their IRA customers for no value-added investment services is irrational.

Additionally, imposing annual asset value fees on Self-Directed IRAs creates a conflict of interest between the IRA custodian and the Self-Directed IRA custodian. Each year the Self-Directed IRA customer must provide the custodian with the annual value of their IRA. The value is then reported by the IRA custodian to the IRS on Form 5498. The value is used for the imposition of required minimum distributions for pre-tax IRA owners over the age of 73. That amount of tax paid by an IRA owner subject to the required minimum distribution rules is wholly dependent on the values provided to the IRA custodian. However, if the Self-Directed IRA customer is concerned about IRA custodian fees, he or she may deflate the value of their IRA to keep their annual IRA custodian fees as low as possible. This puts the Self-Directed IRA customer in a difficult position to juggle their responsibility to provide an accurate annual IRA value for IRS purposes while simultaneously attempting to keep their Self-Directed custodian fees as low as possible.

Understanding Self-Directed IRA Custodian Fees

Over the last several years, the fees involved in establishing and maintaining a Self-Directed IRA account have become more cost-efficient and client-friendly. Depending on the IRA custodian you choose and the type of Self-Directed IRA you establish, custodian controlled vs. checkbook IRA, the type of Self-Directed IRA fees imposed could differ. Irrespective of whether you elect to use a Self-Directed IRA or a Self-Directed IRA LLC, the basic premise of a Self-Directed IRA account is that the IRA owner has total investment control and authority over their IRA. That is where the name “Self-Directed” comes from. Hence, imposing an asset valuation fee on a Self-Directed IRA account does not seem right or fair. For example, if you open a Self-Directed IRA and buy property A for $100,000 and a year later the property’s value went up to $200,000. Why should the Self-Directed IRA custodian charge higher Self-Directed IRA annual custodian fees just because you made a smart investment? A Self-Directed IRA custodian is known as a passive custodian. A Self-Directed IRA custodian is not permitted under law to offer investment advice or promote investments. Hence, why would anyone choose a Self-Directed IRA custodian that charges asset valuation fees? Here is another real example. An individual purchased Bitcoin in 2015 and did not know she chose a custodian that was charging a 1% fee on the value of the Self-Directed IRA as of December 31. Her initial annual Self-Directed IRA custodian fee would be fair. However, by the time Bitcoin hit $40,000 some years later, she was forced to pay thousands of dollars of annual Self-Directed IRA custodian fees to a custodian who added no value. Paying asset value fees to an investment advisor who is providing investment advice and services makes total sense. However, paying asset value fees to a Self-Directed IRA custodian that is offering no investment advice or adding any investment value, makes no sense. The core reason so many Self-Directed IRA investors end up establishing IRA accounts with custodians that charge an annual asset valuation fee is they are either unaware or fail to understand the long-term impact the choice can have on their retirement.

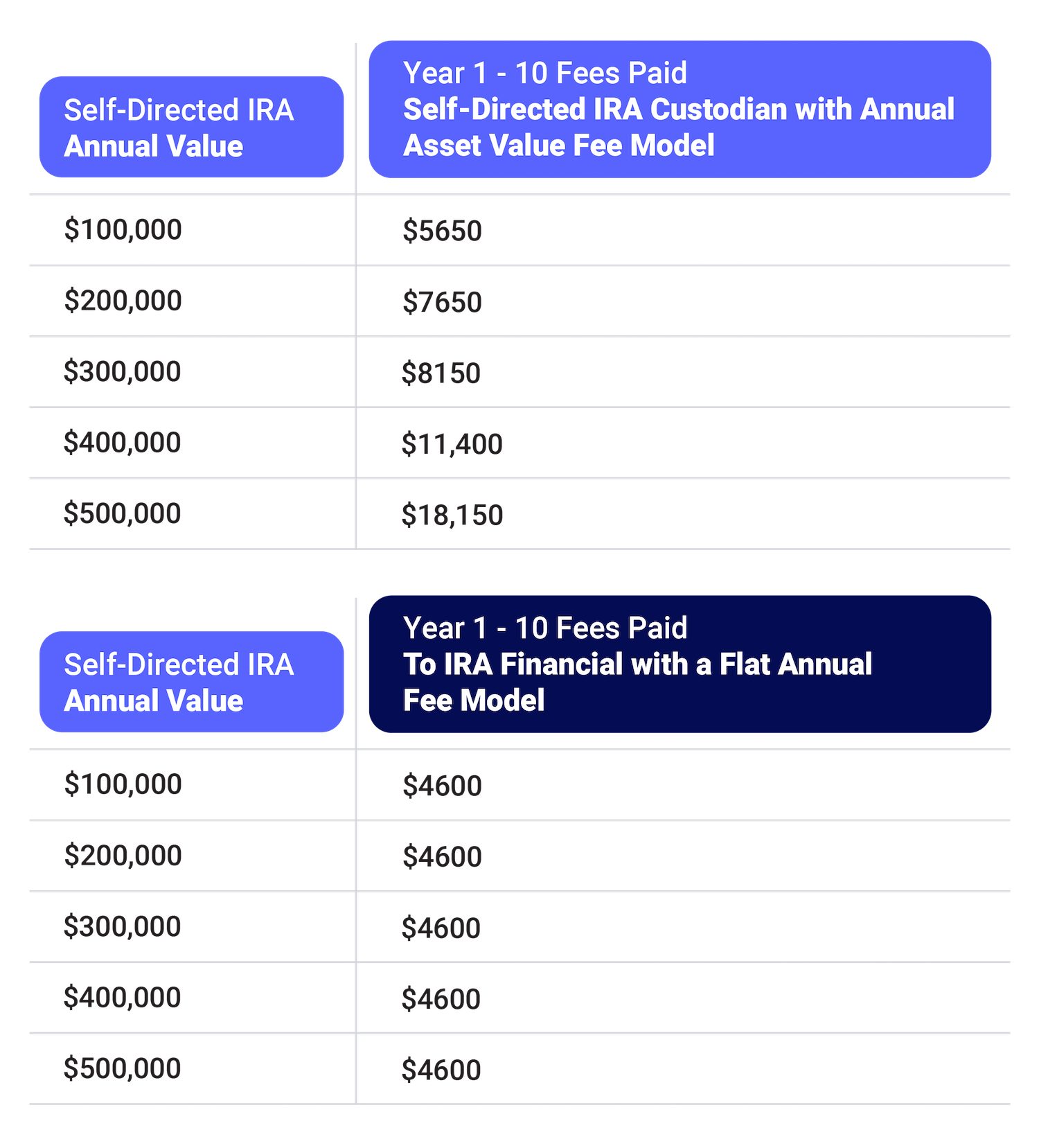

Below is a table that illustrates the significant long-term financial damage done to a retirement account by choosing the wrong Self-Directed IRA custodian. The table shows the difference between choosing to work with IRA Financial, which has flat annual Self-Directed IRA custodian fees, versus a Self-Directed IRA custodian that charges fees based on the annual value of the Self-Directed IRA. The Self-Directed IRA annual value figures are based on the average fees charged by several Self-Directed IRA custodians.

A client with $500k in assets would save nearly $14,000 over ten years.

The above-referenced table is a conservative estimate of the total fees a Self-Directed IRA investor would pay to a custodian that charges annual asset valuation fees. The reason for this is that the table assumes that the customer would maintain the same Self-Directed IRA value over ten years. Consider that if a customer Self-Directed IRA’s assets grew from $200,000 to $400,000 over ten years, the Self-Directed IRA custodian would pay an extra $4,925 cumulatively versus. what they would pay to IRA Financial with a flat annual Self-Directed IRA fee model. That’s $4,925, or 1.64% of their average assets of $300,000 cumulatively over the 10 years.

Conclusion

There is categorically no good reason to establish a Self-Directed IRA with a custodian who will charge your IRA fees based on the value each year. It makes no sense. Why on god’s green earth would you pay fees to a third party for your smart investment decisions and success? It’s not like the Self-Directed IRA custodian is providing you with any investment advice. The Self-Directed IRA custodian is not even permitted by law to offer any investment or financial advice. The good news is that you have other fee options for your Self-Directed IRA. You can always transfer your IRA tax-free to IRA Financial or any other Self-Directed IRA custodian that charges a flat annual fee. Electing to establish a Self-Directed IRA at a custodian that imposes annual asset valuation fees on your IRA is a mistake that will have a long-term impact on you and your family’s financial future.