Self-Directed SIMPLE IRA

Individuals generally transfer IRA (individual retirement account) or rollover eligible qualified retirement plan assets into a Self-Directed IRA LLC structure. You can also roll over after-tax retirement funds to a Self-Directed SIMPLE IRA.

What is the Most Common Way to Fund a Self-Directed SIMPLE IRA?

Transfers and rollovers are types of transactions that allow the movement of assets between similar individual retirement accounts. For example, traditional IRA to Traditional IRA, including Savings incentive match plan for employees of small employers (SIMPLE). A SIMPLE IRA transfer is the most common method of funding a Self-Directed SIMPLE IRA LLC.

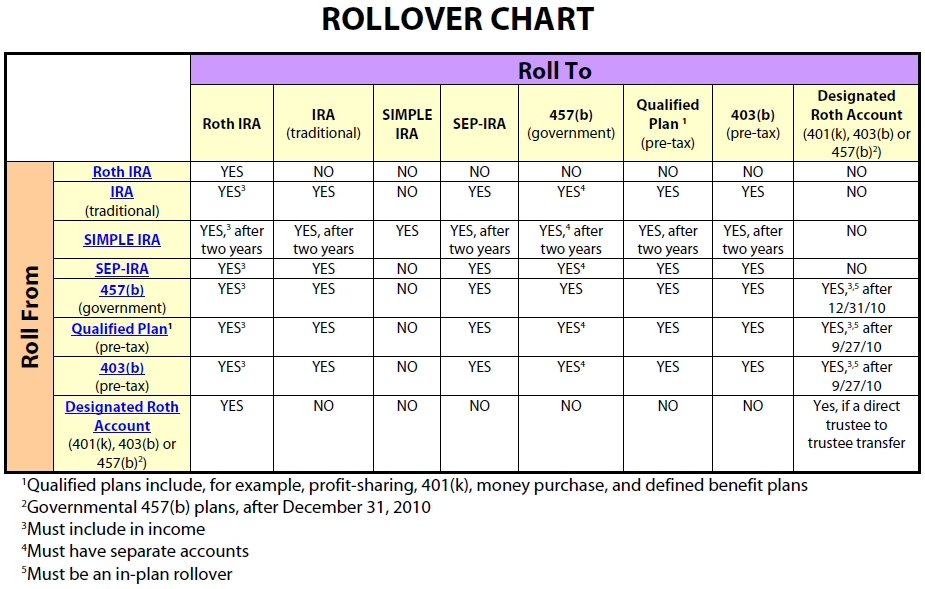

It’s important to note that SIMPLE IRA assets may rolled over to a Self-Directed SIMPLE IRA anytime. However, SIMPLE IRA assets can roll over to a 401(k) qualified retirement plan, 403(b) plan, governmental 457(b) plan, or a Traditional IRA only after you meet a two (2) year waiting period. But a 401(k) qualified retirement plan, 403(b) plan, or governmental 457(b) plan may not roll into a SIMPLE IRA. Also, a Roth IRA cannot be rolled into a SIMPLE IRA.

Rollover Chart

Self-Directed SIMPLE IRA Transfers

A SIMPLE IRA-to SIMPLE IRA transfer is among the most common methods of moving assets from a SIMPLE IRA to a Self-Directed SIMPLE IRA. A transfer usually occurs between two separate financial organizations. However, a transfer can also occur between SIMPLE IRAs held at the same organization. When a SIMPLE IRA transfer is handled correctly, it’s neither taxable nor reportable to the IRS (Internal Revenue Service). With a SIMPLE IRA transfer, the SIMPLE IRA holder directs the transfer, but doesn’t actually receive the IRA assets. Instead, the transaction is completed by the distributing and receiving financial institutions.

In order for the SIMPLE IRA transfer to be tax-free and penalty-free, the IRA holder must not receive the SIMPLE IRA funds in a transfer. The check must be payable to the new individual retirement account custodian. Also, there is no reporting or withholding to the Internal Revenue Service on an IRA transfer.

The retirement tax professionals at the IRA Financial Group will help you fund your Self-Directed SIMPLE IRA LLC. They will transfer your current SIMPLE IRA funds to your new Self-Directed SIMPLE IRA structure. This is tax-free and penalty-free.

How the SIMPLE IRA to Self-Directed IRA Transfer Works?

The Self-Directed Simple IRA is rather simple. We assign you to a retirement tax professional who will help you establish a new Self-Directed SIMPLE IRA account. This occurs at a new FDIC and IRS approved IRA custodian. With your consent, the new custodian then requests the transfer of your SIMPLE IRA assets from your existing individual retirement account custodian. The IRA transfer is tax-free and penalty-free. Once the IRA funds are either transferred by wire or check tax-free to the new SIMPLE IRA custodian, the new custodian will invest the SIMPLE IRA assets into the new SIMPLE IRA LLC “checkbook control” structure. After the transfer of funds to the new SIMPLE IRA LLC, you, as manager of the SIMPLE IRA LLC, will have “checkbook control” over your retirement funds. This means you can make traditional as well as non-traditional investments tax-free and penalty-free.

60-Day Rollover Rule

You generally have 60 days from receipt of the eligible rollover distribution from a SIMPLE IRA account to roll the funds into a Self-Directed SIMPLE IRA LLC structure. The 60-day period starts when you receive the distribution. Usually, no exceptions apply to the 60-day time period. In cases where the 60-day period expires on a Saturday, Sunday, or legal holiday, you can perform the rollover on the following business day.

What happens if you receive the eligible rollover distribution? You may rollover the entire amount or any portion of the amount you receive. The amount of the eligible rollover distribution that you don’t roll into an IRA is generally included in the individual’s gross income. It may be subject to a 10% early distribution penalty if the individual is under the age of 59 1/2.

How the 60-Day Rollover Works with a Self-Directed SIMPLE IRA

The retirement tax professionals at the IRA Financial Group will assist you in rolling over your 60-day eligible rollover distribution to a new FDIC and IRS approved IRA custodian. Once you deposit the 60-day eligible rollover distribution with the new IRA custodian within the 60-day period, the new custodian will be able to invest the SIMPLE IRA assets. You also have the option to establish a Self-Directed IRA LLC with “checkbook control.” If you decide to open a Self-Directed IRA LLC, you will have access to your funds once the transfer process is complete. With a Self-Directed IRA LLC, you, as manager of the SIMPLE IRA LLC, will have “checkbook control” over your retirement funds. You can make traditional as well as non-traditional investments tax-free and penalty-free.

Learn More: