Not all Self-Directed IRAs are the same. The reason for this is that most Self-Directed IRA companies are only offering one type of Self-Directed IRA and do not have the experience and expertise to offer the ultimate Self-Directed IRA solution – the IRA LLC. Adam Bergman, Esq, the founder of IRA Financial, has written 8 books on Self-Directed retirement accounts and was one of the first tax attorneys to design the IRA LLC solution. This article will explore the history of the Self-Directed IRA LLC and illustrate why it is the greatest Self-Directed IRA solution for most Self-Directed IRA investors.

Self-Directed IRA History

The Self-Directed IRA LLC structure was affirmed in the Tax Court case Swanson v. Commissioner, 106 T.C. 76 (1996), and further confirmed by the IRS in Field Service Advisory (FSA) 200128011 (April 6, 2001). The use of a special purpose limited liability company (“LLC”) was designed to provide the IRA owner with limited liability protection as well as greater investment freedom when making IRA investments.

Starting in 2009, Adam Bergman and IRA Financial took the principles of the Swanson case and applied them to the use of an LLC.

What Investments Can I Make with a Self-Directed IRA LLC

A Self-Directed IRA LLC offers one the ability to use his or her retirement funds to make almost any type of investment on their own without requiring the consent of any custodian or person. In fact. the IRS only describes the types of investments that are prohibited, which are very few. The following are some of the more common types of investments that can be made with your Self-Directed IRA LLC:

- Residential or commercial real estate

- Raw land

- Foreclosure property

- Mortgages

- Mortgage pools

- Deeds

- Private loans

- Tax liens

- Private businesses

- Limited Liability Companies

- Limited Liability Partnerships

- Private placements

- Gold

- Stocks, bonds, mutual funds

- Most currencies

What is an LLC

Limited liability companies (“LLCs”) are a creation of state law. An LLC is somewhat of a hybrid entity in that it can be structured to resemble a corporation for owner liability purposes and a partnership for federal income tax purposes. An LLC offers the limited liability the benefit of a corporation and the single level of taxation of a partnership. The owners, not the entity, are then responsible for the payment of the tax, if any.

The reason the LLC is such a perfect vehicle for a Self-Directed IRA is that it is treated as a pass-through entity for tax purposes, offers limited liability protection, plus allows the IRA owner to control the investments and cash of the LLC, It is truly the ultimate Self-Directed IRA solution.

Why is Limited Liability Protection so Important?

The primary reasons to use an LLC for an IRA investment when investing are limited liability protection and pass-through taxation. Protecting one’s IRA assets outside of the LLC is extremely important to many IRA investors and this is why using an LLC as a shield against a creditor attack on the IRA LLC’s owners’ assets outside of the LLC is so important.

For example, Kim has $150,000 in a Self-directed IRA LLC that invests in real estate. Kim also has another $100,000 in her IRA that is invested in other assets. The use of the IRA LLC solution will protect Kim’s IRA assets outside of the LLC ($100,000). Whereas, if Kim did not use an LLC for her Self-Directed IRA real estate investment, a creditor could potentially attack her entire Self-Directed IRA account and assets.

How Does the Self-Directed IRA LLC Work?

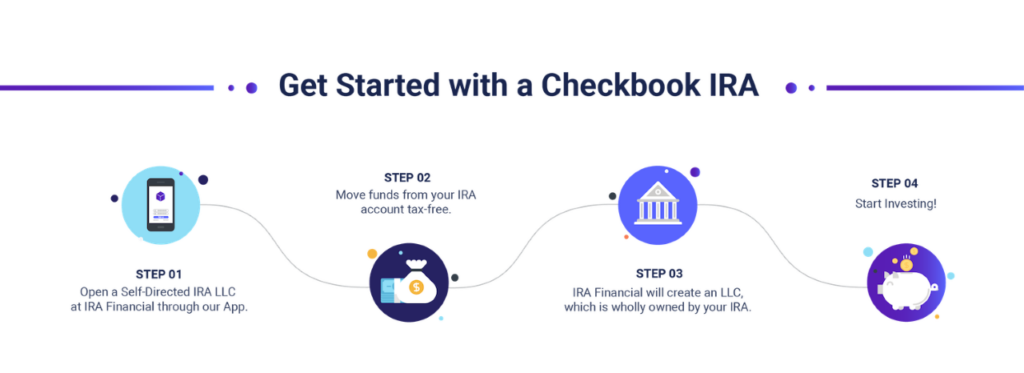

The Self-Directed IRA LLC with “checkbook control” has quickly become the most popular vehicle for investors looking to make alternative assets investments, such as rental real estate that require a high frequency of transactions with limited liability protection. Under the checkbook IRA format, a limited liability company (“LLC”) is created which is funded and owned by the IRA and managed by the IRA owner. The “checkbook control” Self-Directed IRA allows one to eliminate certain costs and delays often associated with using a full-service IRA custodian, plus offers limited liability protection, as well as provides the IRA owner with a greater level of privacy. The Checkbook IRA LLC structure allows the investor to act quickly when the right investment opportunity presents itself cost-effectively and without delay.

Self-Directed IRA LLC Case Study

Jane Smith establishes an IRA with IRA Financial Trust to buy a home in Texas. Jane rolls over $100,000 from his former employer’s 401(k) plan tax-free to IRA Financial Trust. John works with IRA Financial to establish an LLC in the state of Texas. Jane names the LLC JS Investments LLC. IRA Financial acquires a Tax EIN for the LLC and even provides an LLC operating agreement showing the IRA as the owner of the LLC and the IRA owner as the manager. IRA Financial then opens an LLC bank account for JS Investments LLC with Capital One Bank, its banking partner. IRA Financial then sends the funds from the IRA to the LLC via the bank account at Capital One. Jane, as manager of the LLC, then wired the funds to the seller of the real estate. Title to the real estate will be titled in the name of the LLC, JS Investments LLC, and not the IRA since the IRA owns the LLC and the LLC is the entity investing in the real estate.

Why Isn’t the Self-Directed IRA LLC More Popular?

Alternative investments such as real estate have always been permitted in IRAs, but few people seemed to know about this option- until the last several years. This is because large financial institutions have little incentive to recommend something other than stocks, bonds, or mutual funds which bring in extremely profitable commissions and fees for them.

Why use an LLC for Making Self-Directed Investments

A Limited Liability Company (LLC) is a company that has the option to be taxed as a partnership, this is beneficial because the LLC won’t pay any taxes on gains, and instead, it will be the owner of the LLC who is liable for any taxes just as if they earned the money themselves. Because the owner of the LLC is your IRA (the IRA owner is the manager), there are no taxes unless you are running a business that is unrelated to the purpose of an IRA (making investments), using debt financing, or taking a distribution from your IRA. In addition, the LLC offers limited liability and asset protection concerning the assets of the IRA.

What is the Difference Between a Self-Directed IRA at a Brokerage Firm and a Self-Directed IRA LLC with Checkbook Control?

Many “traditional IRA” custodians advertise themselves as offering a Self-Directed IRA with “checkbook control”, but what that means is that you can direct your IRA as long as you direct into one of their offerings. In other words, with a Self-Directed IRA at a brokerage firm, such as Vanguard, you are generally only permitted to invest your IRA funds in investments in equities, mutual funds, bonds, or investments offered by the custodian. Whereas, in the case of a Self-Directed IRA LLC with “checkbook control,” the IRA owner would have the ability to invest in almost any investment, such as real estate, investment funds, precious metals, cryptocurrencies, notes, private businesses, etc.

What is the Difference Between a Full-Service Self-Directed IRA vs. a Self-Directed IRA LLC with Checkbook Control?

A full-service Self-Directed IRA offers an IRA investor more investment options than a financial institution Self-Directed IRA. With a full-service Self-Directed IRA, a special IRA custodian, such as IRA Financial, will serve as the custodian of the IRA. A full-service Self-Directed IRA is the most common way to self-direct your retirement funds. Unlike a typical financial institution, a Self-Directed IRA custodian generates fees simply by opening and maintaining IRA accounts and does not offer any financial investment products or platforms. With a full-service Self-Directed IRA, the IRA funds are held with the IRA custodian, and at the IRA holder’s sole direction, the IRA custodian will then invest the IRA funds into alternative asset investments, such as real estate. Title to the IRA asset will be held in the name of the IRA. For example, IRA Financial Trust Company FBO John Doe IRA.

With the Self-Directed IRA LLC with “checkbook control” solution, the IRA owner will have the ability to gain directed limited liability protection, eliminate costs and delays often associated with a full-service Self-Directed IRA, plus gain additional privacy. The Checkbook IRA LLC structure allows the investor to act quickly when the right investment opportunity presents itself cost-effectively and without delay.

Does IRA Financial Establish the LLC?

Yes. IRA Financial will handle all functions relating to the establishment of the Self-Directed IRA LLC. IRA Financial will establish the special purpose LLC, acquire the IRS EIN, and also draft the IRS-required special purpose Self-Directed IRA LLC operating agreement. In addition, IRA Financial’s tax professionals will help you structure your Self-Directed IRA LLC investment to minimize tax and maximize investment and retirement benefits.

The IRA Financial Advantage

IRA Financial “literally” wrote the book on the Self-Directed IRA. Our founder, Adam Bergman, Esq, has written 8 books on Self-Directed retirement plans and over the last 15+ years has helped over 24,000 Self-Directed clients invest over $3.2 billion in alternative assets.

IRA Financial Self-Directed IRA is specifically designed and customized for each type of investment. Whether it is real estate, private equity, venture capital, hedge fund, private business, cryptos, precious metals, hard money loans, or much more, our Self-Directed tax experts will work with you to design the perfect Self-Directed IRA solution for your investment. Additionally, IRA Financial is the only Self-Directed retirement company that provides annual consulting, IRS tax reporting/filings, BOI FinCEN reporting, and full IRS audit guarantee.

See for yourself why IRA Financial is one of the leading providers of Self-Directed IRAs in the country:

- Customized Self-Directed IRA design for your investment

- Flat annual fees

- No transaction or asset value fees

- No wire of check fees

- IRA & 401(k) personalized rollover support

- IRS tax reporting, including IRS Form 5498 & 1099-R

- BOI Reporting with FinCEN

- LLC IRS tax filing (Form 1065) and UBIT tax filings (Form 990-T)

- Free Self-Directed Roth IRA conversion

- Free RMD support

- Free tax research on Self-Directed IRA topics

One-on-one tax support on the “disqualified person” and “prohibited transaction rules.”

- One-on-one tax consultation on UBTI and UDFI rules

- Free access to our best-selling Self-Directed IRA books

- Free access to our educational webinars, podcasts, and newsletters

- Self-Directed IRA IRS audit guaranty

- Free HSA & Coverdell account for year 1 (value of $920)

Conclusion

Many Self-Directed IRA custodians advertise themselves as offering a Self-Directed IRA, but what they are not telling you is that you will need to seek their consent and pay their fees before making an IRA investment and not gain any limited liability protection. To this end, the IRA custodian will impose an annual fee based on the valuation of the IRA plus a per transaction fee. Whereas, the IRA Financial Self-Directed IRA LLC is the ultimate retirement and investment solution for any investor looking to gain investment freedom and invest their IRA funds into almost any alternative asset investment. The great thing about the Self-Directed IRA LLC solution is that as an investor, when you find an investment that you want to make with your IRA funds, simply write a check or wire the funds straight from your Self-Directed IRA LLC bank account to make the investment.